Technological Innovations

Technological advancements are a key driver in the Distribution Transformer Market. Innovations such as smart transformers, which incorporate digital technology for monitoring and control, are gaining traction. These transformers enhance operational efficiency and provide real-time data, allowing for better management of electrical loads. The market is also seeing the development of materials that improve transformer performance and longevity. As these technologies evolve, they are likely to reshape the landscape of the Distribution Transformer Market, offering new opportunities for manufacturers and utilities alike.

Renewable Energy Integration

The shift towards renewable energy sources is significantly influencing the Distribution Transformer Market. As countries strive to meet sustainability goals, the integration of solar and wind energy into the grid is becoming more prevalent. This transition requires advanced distribution transformers capable of handling variable loads and ensuring grid stability. The market is witnessing a surge in demand for transformers that can efficiently manage the influx of renewable energy. It is estimated that by 2025, renewable energy sources will account for over 30% of total electricity generation, further driving the need for innovative solutions within the Distribution Transformer Market.

Rising Demand for Electricity

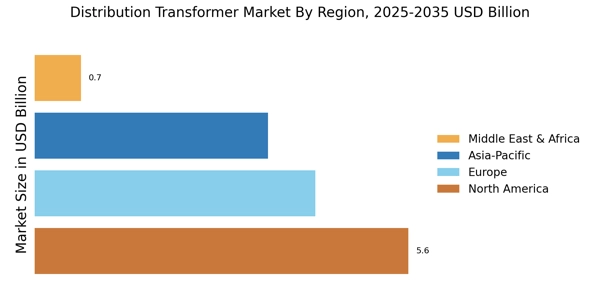

The increasing demand for electricity across various sectors is a primary driver for the Distribution Transformer Market. As urbanization accelerates and populations grow, the need for reliable power supply becomes paramount. According to recent data, electricity consumption is projected to rise by approximately 3% annually, necessitating the installation of more distribution transformers to meet this demand. This trend is particularly evident in developing regions, where infrastructure development is underway. The Distribution Transformer Market must adapt to this growing need by enhancing transformer capacity and efficiency to ensure a stable power supply.

Increased Investment in Smart Grids

The Distribution Transformer Industry. Smart grids facilitate better energy management and distribution, requiring advanced transformers that can communicate with other grid components. Investments in smart grid infrastructure are expected to reach billions in the coming years, driven by the need for improved reliability and efficiency in power distribution. This trend not only enhances the operational capabilities of the Distribution Transformer Market but also aligns with broader goals of sustainability and energy conservation.

Government Regulations and Incentives

Government regulations aimed at enhancing energy efficiency and reducing carbon emissions are shaping the Distribution Transformer Market. Many countries are implementing stringent standards for transformer efficiency, which encourages manufacturers to innovate and produce more efficient models. Incentives for upgrading aging infrastructure also play a crucial role in this market. For instance, programs that subsidize the cost of energy-efficient transformers are becoming more common, leading to increased adoption rates. This regulatory environment is expected to propel the Distribution Transformer Market forward, as stakeholders seek to comply with new standards while improving overall grid performance.