Europe and South America Transformer Station Market Summary

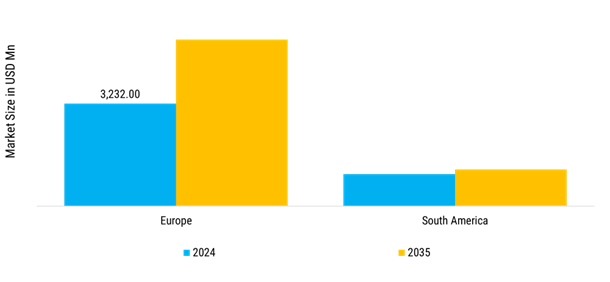

Europe and South America Transformer Station Market Size was valued at USD 4,242.00 million in 2024. The Transformer Station Market industry is projected to grow from USD 4,312.09 million in 2025 to USD 6,395.61 million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.0% during the forecast period (2025 - 2035).

Key Market Trends & Highlights

The Europe and South America Transformer Station Market is experiencing robust growth driven by the accelerating integration of renewable energy sources, rapid urbanization, and the modernization of aging electrical infrastructure.

- The market is witnessing increased demand for smart grid integration and digital substations, particularly in Europe, which remains the largest market.

- Distribution substations are becoming focal points for businesses, especially in South America, which is experiencing rapid infrastructure expansion.

- Integration with renewable energy systems is gaining traction, with outdoor transformer stations leading the market while digital monitoring solutions are rapidly expanding.

- Rising adoption of ultra-high voltage (UHV) substations and the growing need for grid modernization are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 4,242.00 (USD Million) |

| 2025 Market Size | 4,312.09 (USD Million) |

| 2035 Market Size | 6,395.61 (USD Million) |

| CAGR (2025 - 2035) | 4.0% |