Regulatory Framework Enhancements

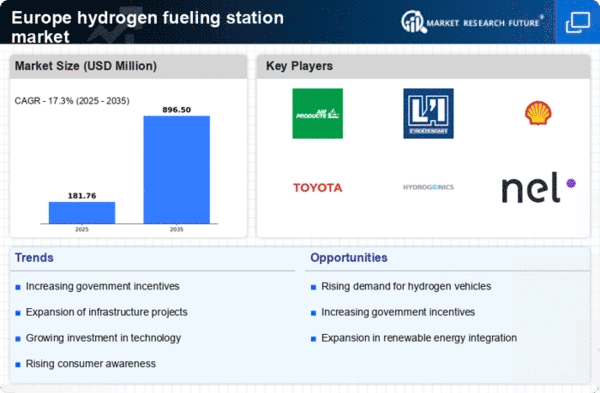

The hydrogen fueling station market in Europe is experiencing a robust transformation due to the establishment of comprehensive regulatory frameworks. Governments are implementing stringent emissions regulations, which are compelling industries to transition towards cleaner energy sources. The European Union has set ambitious targets to reduce greenhouse gas emissions by at least 55% by 2030, which is likely to drive investments in hydrogen infrastructure. Furthermore, the European Hydrogen Strategy aims to produce up to 10 million tonnes of renewable hydrogen by 2030, thereby creating a conducive environment for the hydrogen fueling-station market. This regulatory impetus not only encourages the development of hydrogen stations but also fosters collaboration among stakeholders, including public and private sectors, to enhance the overall ecosystem of hydrogen mobility.

Investment in Infrastructure Development

Investment in infrastructure development is a critical driver for the hydrogen fueling-station market in Europe. As the demand for hydrogen fuel increases, substantial financial resources are being allocated to build and expand hydrogen refueling networks. According to recent estimates, the European hydrogen infrastructure market is projected to reach approximately €30 billion by 2030. This influx of capital is likely to facilitate the establishment of new fueling stations, particularly in urban areas where the adoption of hydrogen vehicles is gaining momentum. Additionally, partnerships between governments and private enterprises are emerging, which may further accelerate the deployment of hydrogen stations. The strategic placement of these stations is essential to ensure accessibility and convenience for consumers, thereby promoting the adoption of hydrogen as a viable alternative to traditional fuels.

Rising Consumer Awareness and Acceptance

Rising consumer awareness and acceptance of hydrogen as a clean energy source is emerging as a pivotal driver for the hydrogen fueling-station market in Europe. As environmental concerns become more pronounced, consumers are increasingly seeking sustainable alternatives to fossil fuels. Surveys indicate that approximately 70% of European consumers are open to adopting hydrogen vehicles, provided that adequate refueling infrastructure is available. This growing acceptance is likely to encourage manufacturers to invest in hydrogen vehicle production, thereby increasing the demand for fueling stations. Furthermore, educational campaigns and public demonstrations are playing a crucial role in informing consumers about the benefits of hydrogen technology, which may lead to a more favorable perception and greater market penetration of hydrogen vehicles.

Collaborative Initiatives Among Stakeholders

Collaborative initiatives among stakeholders are playing a vital role in shaping the hydrogen fueling-station market in Europe. Various partnerships between governments, private companies, and research institutions are being formed to accelerate the development of hydrogen infrastructure. These collaborations often focus on sharing knowledge, resources, and best practices, which can lead to more efficient project execution. For instance, initiatives like the Hydrogen Mobility Europe project aim to create a unified network of hydrogen stations across multiple countries, enhancing cross-border accessibility. Such collaborative efforts not only streamline the deployment of hydrogen fueling stations but also foster innovation and technological advancements within the industry. The synergy created through these partnerships is likely to bolster the overall growth and sustainability of the hydrogen fueling-station market.

Technological Innovations in Hydrogen Production

Technological innovations in hydrogen production are significantly influencing the hydrogen fueling-station market in Europe. Advances in electrolysis technology, particularly the development of more efficient and cost-effective methods, are enhancing the feasibility of producing green hydrogen. The cost of producing hydrogen through electrolysis has decreased by approximately 50% over the past few years, making it a more attractive option for fueling stations. Moreover, the integration of renewable energy sources, such as wind and solar, into hydrogen production processes is likely to further reduce costs and improve sustainability. These technological advancements not only support the growth of hydrogen fueling stations but also align with the broader goals of the European Green Deal, which aims to promote a sustainable and low-carbon economy.