Investment in Infrastructure Development

The hydrogen fueling-station market in South Korea is experiencing a surge in investment aimed at infrastructure development. The government has allocated substantial funding, approximately $2 billion, to enhance the network of hydrogen stations across the country. This investment is crucial for establishing a robust infrastructure that supports the growing demand for hydrogen fuel. As of November 2025, South Korea is expected to have over 100 operational hydrogen stations, with plans to increase this number significantly. The expansion of infrastructure not only facilitates easier access for consumers but also encourages the adoption of hydrogen fuel cell vehicles. This trend indicates a strong commitment from both public and private sectors to develop a comprehensive hydrogen ecosystem, which is essential for the long-term sustainability of the hydrogen fueling-station market.

Public Awareness and Consumer Acceptance

Public awareness and consumer acceptance play a pivotal role in the hydrogen fueling-station market in South Korea. As educational campaigns and promotional activities increase, more consumers are becoming aware of the benefits of hydrogen fuel cell vehicles. Surveys indicate that approximately 60% of the population is now familiar with hydrogen technology, a significant increase from previous years. This growing awareness is likely to translate into higher adoption rates of hydrogen vehicles, which in turn drives demand for fueling stations. The market is expected to see a 30% increase in consumer interest in hydrogen vehicles by 2026. This shift in consumer behavior is crucial for the hydrogen fueling-station market, as it creates a favorable environment for investment and expansion.

Technological Innovations in Fueling Solutions

Technological innovations are significantly impacting the hydrogen fueling-station market in South Korea. Advances in fueling technology, such as high-capacity dispensers and improved storage solutions, are enhancing the efficiency and safety of hydrogen refueling. As of November 2025, new technologies are enabling stations to reduce refueling times to under 5 minutes, making hydrogen vehicles more appealing to consumers. Furthermore, the integration of renewable energy sources in hydrogen production is becoming more prevalent, which not only lowers costs but also aligns with sustainability goals. These innovations are likely to attract more investments into the hydrogen fueling-station market, fostering a competitive landscape that encourages further advancements.

Collaboration Between Public and Private Sectors

Collaboration between public and private sectors is emerging as a key driver for the hydrogen fueling-station market in South Korea. Partnerships between government entities and private companies are facilitating the development of new hydrogen stations and technologies. For instance, joint ventures are being formed to share resources and expertise, which accelerates the deployment of hydrogen infrastructure. As of November 2025, several major automotive manufacturers are collaborating with the government to establish a network of hydrogen stations, aiming to have over 200 stations operational by 2030. This collaborative approach not only enhances the market's growth potential but also ensures that the hydrogen fueling-station market is well-positioned to meet future demands.

Environmental Regulations and Sustainability Goals

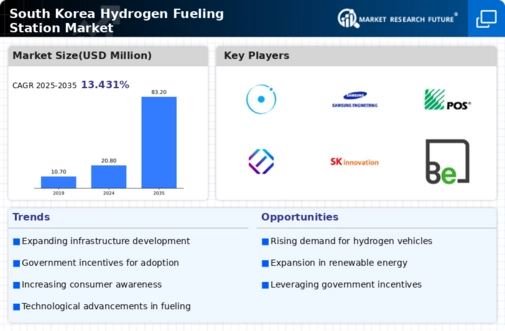

In South Korea, stringent environmental regulations and ambitious sustainability goals are driving the hydrogen fueling-station market. The government aims to reduce greenhouse gas emissions by 40% by 2030, which necessitates a shift towards cleaner energy sources. Hydrogen, being a zero-emission fuel, aligns perfectly with these objectives. As of November 2025, the hydrogen fueling-station market is projected to grow at a CAGR of 25% over the next five years, largely due to these regulatory pressures. The push for sustainable energy solutions is compelling businesses to invest in hydrogen technologies, thereby enhancing the market's growth potential. This regulatory environment not only fosters innovation but also positions South Korea as a leader in the transition to a hydrogen-based economy.