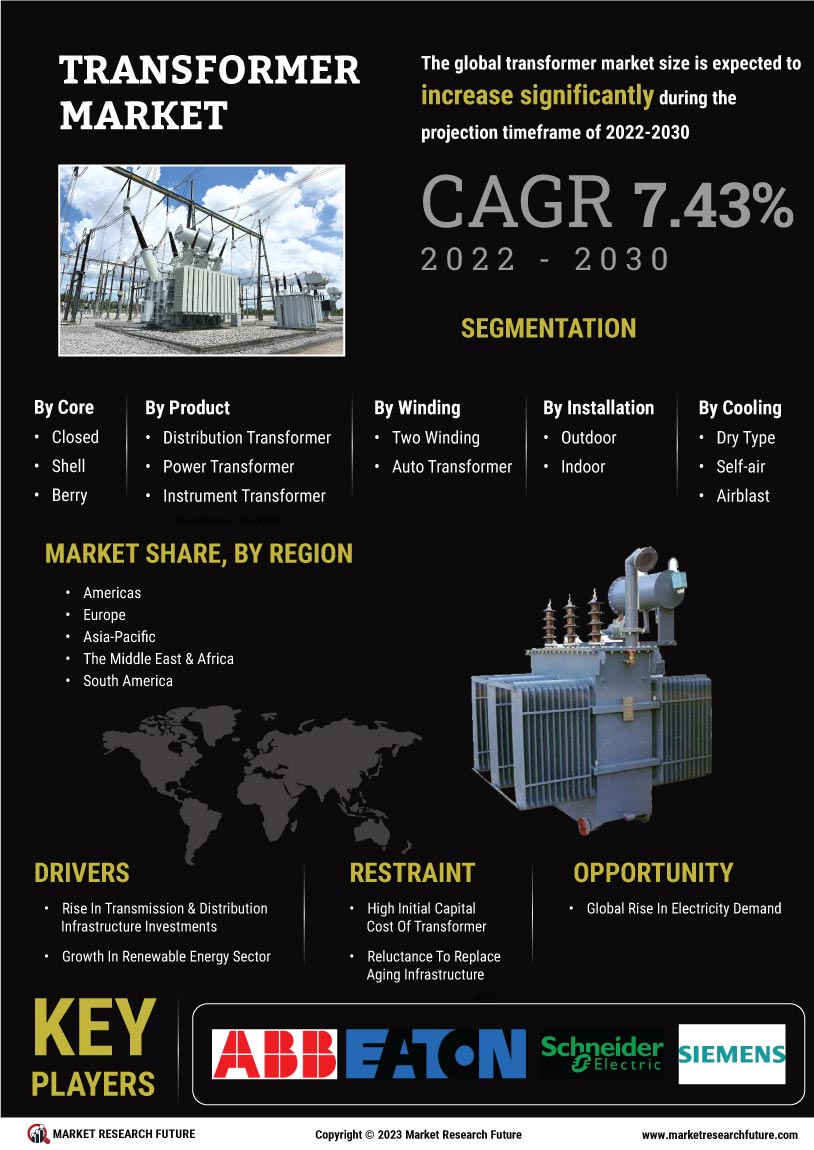

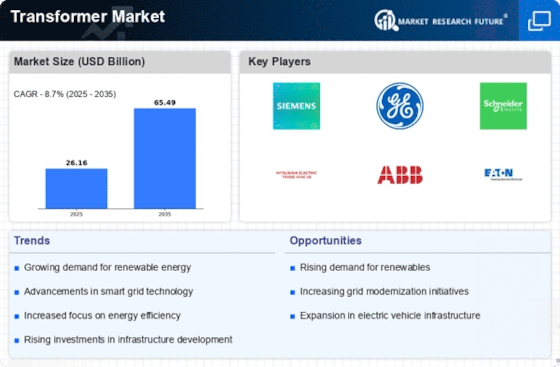

Rising Demand for Electricity

The increasing demand for electricity across various sectors is a primary driver for the Transformer Market. As urbanization and industrialization continue to expand, the need for reliable power supply becomes paramount. According to recent data, electricity consumption is projected to rise by approximately 2.5% annually. This surge necessitates the installation of more transformers to ensure efficient distribution and management of electrical power. Consequently, the Transformer Market is likely to experience significant growth as utilities and industries invest in upgrading their infrastructure to meet this escalating demand. Furthermore, the transition towards electrification in transportation and heating sectors further amplifies the need for robust transformer solutions, thereby enhancing the market's potential.

Government Initiatives and Regulations

Government initiatives aimed at enhancing energy infrastructure and promoting renewable energy sources are pivotal in shaping the Transformer Market. Various countries have implemented policies that encourage the adoption of advanced transformer technologies, which are essential for integrating renewable energy into existing grids. For instance, incentives for solar and wind energy projects often include provisions for upgrading transformer systems to handle variable loads. This regulatory support not only stimulates investment in the Transformer Market but also fosters innovation in transformer design and efficiency. As governments continue to prioritize energy security and sustainability, the demand for transformers that comply with new standards is expected to rise, further propelling market growth.

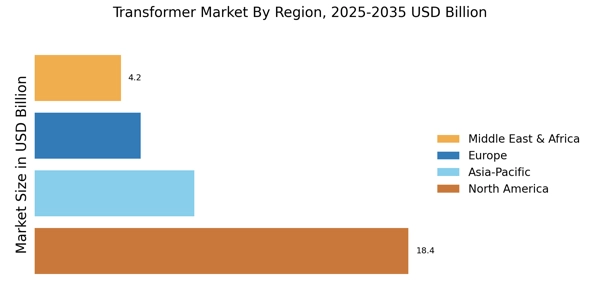

Urbanization and Infrastructure Development

Urbanization and infrastructure development are driving forces behind the Transformer Market. As populations migrate to urban areas, the demand for reliable electricity supply increases, necessitating the expansion of electrical infrastructure. This trend is particularly evident in emerging economies, where rapid urban growth is occurring. The International Energy Agency projects that investment in electricity infrastructure will need to reach approximately 1 trillion dollars annually to meet future demand. This investment will likely include the installation of new transformers and the upgrading of existing systems to ensure they can handle increased loads. As such, the Transformer Market is poised for growth, driven by the need to support urbanization and the associated infrastructure demands.

Technological Advancements in Transformer Design

Technological advancements in transformer design and manufacturing processes are significantly influencing the Transformer Market. Innovations such as smart transformers, which incorporate digital technology for enhanced monitoring and control, are gaining traction. These transformers offer improved efficiency and reliability, which are critical in modern power systems. The market for smart transformers is anticipated to grow at a compound annual growth rate of over 10% in the coming years. Additionally, advancements in materials, such as amorphous steel and high-temperature superconductors, are enhancing the performance and reducing the size of transformers. As these technologies become more prevalent, they are likely to reshape the Transformer Market, making it more competitive and efficient.

Increased Investment in Renewable Energy Projects

The surge in investment in renewable energy projects is a crucial driver for the Transformer Market. As nations strive to meet their climate goals, there is a marked shift towards solar, wind, and other renewable energy sources. This transition necessitates the deployment of transformers that can efficiently manage the integration of these energy sources into the grid. Recent estimates indicate that global investment in renewable energy could exceed 2 trillion dollars annually by 2030. Such substantial financial commitments are expected to create a robust demand for transformers, particularly those designed for renewable applications. Consequently, the Transformer Market stands to benefit significantly from this trend, as it aligns with the broader movement towards sustainable energy solutions.