E-commerce Growth

The rapid growth of e-commerce is significantly impacting the Europe Commercial Printing Market. As online shopping continues to expand, businesses require effective marketing materials, packaging, and promotional items to engage consumers. In 2025, the e-commerce sector in Europe is projected to reach a value of over 800 billion euros, driving demand for printed materials. This surge in online retail creates opportunities for print service providers to offer innovative solutions, such as packaging that enhances the unboxing experience. Additionally, e-commerce businesses often seek short-run printing options to adapt to changing market trends. As a result, the interplay between e-commerce growth and the printing industry is likely to foster new avenues for revenue generation within the Europe Commercial Printing Market.

Regulatory Compliance

Regulatory compliance is a critical driver in the Europe Commercial Printing Market. The printing sector is subject to various regulations concerning environmental standards, labor practices, and product safety. In 2025, compliance with the EU's REACH regulation, which governs the use of chemicals in printing processes, remains a priority for many companies. Adhering to these regulations not only mitigates legal risks but also enhances corporate responsibility. Companies that proactively engage in compliance efforts may benefit from improved operational efficiencies and reduced costs associated with non-compliance penalties. Furthermore, as consumers increasingly favor brands that demonstrate ethical practices, regulatory compliance can serve as a differentiator in the competitive landscape of the Europe Commercial Printing Market.

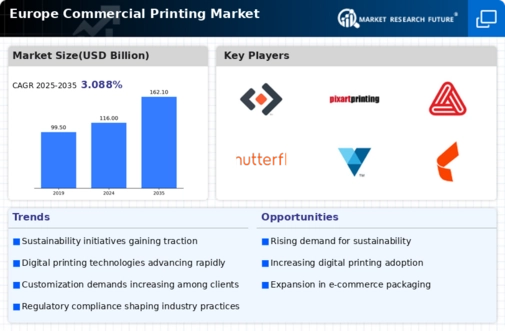

Sustainability Initiatives

The Europe Commercial Printing Market is increasingly influenced by sustainability initiatives. As environmental concerns gain prominence, businesses are adopting eco-friendly practices. This includes the use of sustainable materials, such as recycled paper and vegetable-based inks. In 2025, approximately 60% of printing companies in Europe reported implementing sustainable practices, reflecting a growing commitment to reducing carbon footprints. Regulatory frameworks, such as the European Union's Green Deal, further encourage this shift by promoting circular economy principles. Consequently, companies that prioritize sustainability may gain a competitive edge, appealing to environmentally conscious consumers and businesses alike. This trend not only enhances brand reputation but also aligns with the broader societal push towards sustainability, potentially driving growth in the Europe Commercial Printing Market.

Technological Advancements

Technological advancements play a pivotal role in shaping the Europe Commercial Printing Market. Innovations such as digital printing, automation, and artificial intelligence are transforming traditional printing processes. In 2025, digital printing accounted for over 30% of the total printing volume in Europe, indicating a significant shift towards more efficient and cost-effective solutions. These technologies enable faster turnaround times, reduced waste, and enhanced customization options. Moreover, advancements in software and workflow management systems streamline operations, allowing companies to respond swiftly to market demands. As businesses increasingly adopt these technologies, they are likely to improve productivity and profitability, thereby contributing to the overall growth of the Europe Commercial Printing Market.

Customization and Personalization

Customization and personalization are emerging as key drivers in the Europe Commercial Printing Market. As consumer preferences evolve, businesses are seeking ways to differentiate their offerings through tailored products. In 2025, nearly 40% of print service providers in Europe reported an increase in demand for personalized printing solutions. This trend is particularly evident in sectors such as packaging, where brands aim to create unique experiences for consumers. The ability to produce small runs of customized products at competitive prices is facilitated by advancements in digital printing technology. Consequently, companies that embrace customization may enhance customer satisfaction and loyalty, positioning themselves favorably within the competitive landscape of the Europe Commercial Printing Market.