Advancements in Video Technology

Technological advancements play a crucial role in shaping the Enterprise Video Market. Innovations such as high-definition video streaming, augmented reality, and virtual reality are transforming how organizations utilize video for training, marketing, and internal communications. The integration of these technologies enhances user experience and engagement, making video content more appealing and effective. Furthermore, the rise of 5G technology is expected to facilitate faster and more reliable video streaming, thereby expanding the potential applications of video in various sectors. As these advancements continue to evolve, they are likely to drive further growth in the Enterprise Video Market.

Emergence of Interactive Video Solutions

The emergence of interactive video solutions is reshaping the Enterprise Video Market. These solutions allow viewers to engage with content in real-time, fostering a more immersive experience. Features such as clickable links, quizzes, and personalized content are becoming increasingly popular among businesses seeking to enhance viewer engagement. Data suggests that interactive video can lead to a 300% increase in click-through rates compared to standard video formats. As organizations recognize the potential of interactive video to drive engagement and conversion, investments in these technologies are likely to increase, further propelling the growth of the Enterprise Video Market.

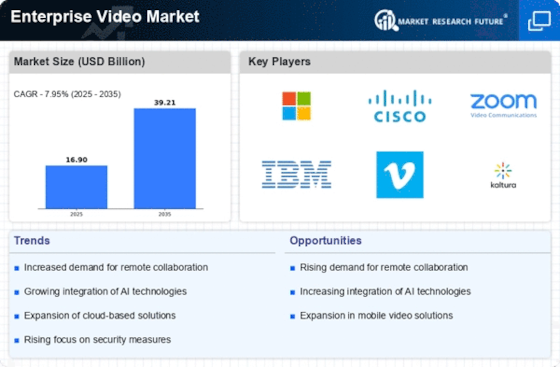

Rising Demand for Remote Collaboration Tools

The Enterprise Video Market experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms, webinars, and virtual training sessions are now essential for maintaining productivity and engagement among dispersed teams. According to recent data, the market for video conferencing solutions is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This trend indicates that businesses are prioritizing video communication as a core component of their operational strategies, thereby driving growth within the Enterprise Video Market.

Growing Importance of Video Content in Marketing

In the contemporary business landscape, the Enterprise Video Market is significantly influenced by the growing importance of video content in marketing strategies. Companies are increasingly leveraging video to enhance brand visibility and engage customers effectively. Research indicates that video content can lead to a 1200% increase in shares on social media, highlighting its potential to amplify marketing efforts. As organizations recognize the value of video in storytelling and customer engagement, investments in video production and distribution platforms are likely to rise. This shift not only enhances customer interaction but also propels the growth of the Enterprise Video Market.

Increased Focus on Employee Training and Development

The Enterprise Video Market is witnessing a heightened focus on employee training and development. Organizations are increasingly adopting video-based training solutions to enhance learning experiences and improve knowledge retention. Studies suggest that video training can increase retention rates by up to 80% compared to traditional methods. As companies strive to upskill their workforce and adapt to changing market demands, the investment in video training platforms is expected to rise. This trend not only supports employee development but also contributes to the overall growth of the Enterprise Video Market.