Advancements in Video Technology

Technological advancements play a crucial role in shaping the enterprise video market in Canada. Innovations such as 4K video resolution, augmented reality (AR), and virtual reality (VR) are transforming how businesses utilize video content. These technologies enable organizations to create immersive experiences that enhance viewer engagement and comprehension. The integration of high-definition video capabilities is particularly relevant in sectors such as education and corporate training, where visual clarity is essential. As a result, the enterprise video market is likely to see increased investment in cutting-edge video solutions that leverage these advancements, thereby improving the quality and effectiveness of video communications.

Regulatory Compliance and Security Concerns

In the enterprise video market, regulatory compliance and security concerns are becoming increasingly prominent. Organizations must navigate a complex landscape of data protection regulations, particularly when handling sensitive information during video communications. The need for secure video conferencing solutions is paramount, as breaches can lead to significant financial and reputational damage. Consequently, businesses are prioritizing platforms that offer robust security features, such as end-to-end encryption and secure access controls. This focus on compliance and security is shaping the enterprise video market, driving demand for solutions that not only facilitate communication but also safeguard organizational data.

Growing Demand for Remote Collaboration Tools

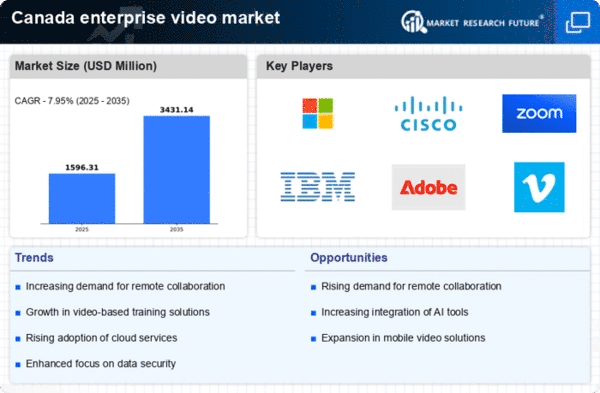

The enterprise video market in Canada experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms, webinars, and virtual training sessions are essential for maintaining productivity and engagement among remote teams. According to recent data, the market for video conferencing solutions is projected to grow at a CAGR of 15% through 2026. This trend indicates that businesses are prioritizing video communication as a core component of their operational strategies. Consequently, the enterprise video market is witnessing a transformation, with companies investing in advanced video technologies to enhance collaboration and streamline workflows.

Rising Focus on Employee Training and Development

In the enterprise video market, there is a marked emphasis on employee training and development initiatives. Organizations in Canada recognize the value of video content in delivering training programs that are both engaging and effective. The use of video-based learning modules has been shown to improve knowledge retention rates by up to 60%. As companies strive to upskill their workforce, the demand for video training solutions is expected to rise significantly. This shift not only enhances employee performance but also contributes to overall organizational growth. The enterprise video market is thus evolving to accommodate the increasing need for innovative training methodologies, positioning video as a vital tool in the learning and development landscape.

Increased Investment in Marketing and Brand Awareness

The enterprise video market in Canada is witnessing a surge in investment aimed at enhancing marketing and brand awareness. Companies are increasingly utilizing video content to convey their brand messages and engage with customers effectively. Video marketing has been shown to increase conversion rates by up to 80%, making it a powerful tool for businesses looking to expand their reach. As organizations recognize the potential of video to drive customer engagement, the enterprise video market is likely to experience growth in demand for video production and distribution services. This trend underscores the importance of video as a strategic asset in modern marketing efforts.