Focus on Cost Efficiency and ROI

The enterprise video market in Germany is also influenced by the growing focus on cost efficiency and return on investment (ROI). Organizations are increasingly evaluating the financial implications of their video solutions, seeking to maximize value while minimizing costs. The ability to reduce travel expenses, streamline communication, and enhance productivity through video conferencing tools is becoming a key consideration for businesses. Recent analyses indicate that companies can save up to €11,000 annually per employee by adopting video solutions for remote collaboration. This financial incentive drives organizations to invest in the enterprise video market, as they aim to achieve measurable outcomes and justify their expenditures on video technologies.

Emphasis on Training and Development

The enterprise video market in Germany is increasingly shaped by the emphasis on training and development initiatives. Organizations are leveraging video solutions to deliver engaging training programs, onboarding sessions, and skill development workshops. This approach not only enhances learning outcomes but also allows for scalable training solutions that can reach a wider audience. Recent surveys indicate that approximately 70% of companies in Germany are utilizing video content for employee training purposes. This trend underscores the importance of video as a tool for knowledge transfer and employee engagement. Consequently, the enterprise video market is witnessing a shift towards creating tailored video content that aligns with organizational goals and employee needs.

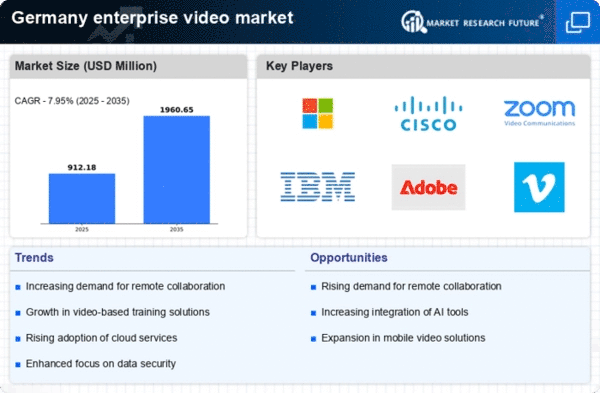

Growing Demand for Remote Collaboration

The enterprise video market in Germany experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing platforms are now essential for facilitating meetings, training sessions, and team collaborations. Recent data indicates that the market for video conferencing solutions in Germany is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the necessity for seamless interaction among geographically dispersed teams, thereby enhancing productivity and operational efficiency. Consequently, the enterprise video market is witnessing a transformation, as companies seek to invest in robust video solutions that cater to their evolving collaboration needs.

Rising Importance of Customer Engagement

In the context of the enterprise video market, customer engagement emerges as a critical driver in Germany. Businesses are increasingly utilizing video content to enhance customer interactions, whether through webinars, product demonstrations, or personalized video messages. This strategy not only fosters stronger relationships with clients but also aids in conveying complex information effectively. Data suggests that companies employing video in their marketing strategies experience a 49% higher engagement rate compared to those that do not. As organizations recognize the potential of video to drive customer loyalty and satisfaction, the enterprise video market is adapting to meet these evolving demands, focusing on creating impactful video experiences.

Investment in Advanced Video Technologies

In Germany, the enterprise video market is significantly influenced by the increasing investment in advanced video technologies. Organizations are recognizing the value of high-definition video, interactive features, and cloud-based solutions to enhance user experience. The integration of features such as screen sharing, virtual backgrounds, and real-time collaboration tools is becoming commonplace. According to recent statistics, the revenue generated from video technology solutions in Germany is expected to reach €1 billion by 2026. This investment trend reflects a broader shift towards digital transformation, where businesses prioritize innovative video solutions to stay competitive. As a result, the enterprise video market is evolving rapidly, with companies striving to adopt cutting-edge technologies that meet the demands of modern communication.