Emergence of Video Marketing Strategies

The enterprise video market in France is witnessing a transformation driven by the emergence of video marketing strategies. Businesses are increasingly recognizing the power of video content in reaching and engaging their target audiences. With approximately 80% of consumers preferring video over text for information, companies are investing in high-quality video production to enhance their marketing efforts. This shift is particularly evident in sectors such as retail and technology, where visual storytelling plays a crucial role in brand differentiation. As a result, the enterprise video market is poised for growth, as organizations seek to capitalize on the effectiveness of video marketing to boost customer engagement and drive sales.

Growing Focus on Data Analytics and Insights

The enterprise video market in France is increasingly characterized by a growing focus on data analytics and insights. Organizations are recognizing the importance of measuring the effectiveness of their video content to optimize engagement and ROI. By utilizing analytics tools, companies can gain valuable insights into viewer behavior, preferences, and content performance. This data-driven approach enables businesses to tailor their video strategies to better meet audience needs. Recent findings indicate that approximately 65% of French enterprises are now employing analytics to assess their video initiatives. As a result, the enterprise video market is expected to thrive as organizations prioritize data-driven decision-making in their video content strategies.

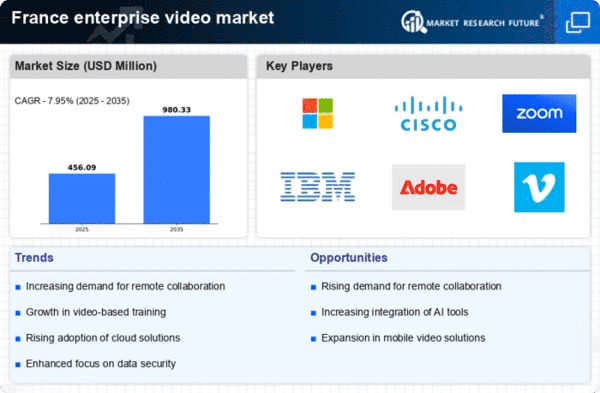

Rising Demand for Remote Collaboration Tools

The enterprise video market in France experiences a notable surge in demand for remote collaboration tools. As organizations increasingly adopt hybrid work models, the need for effective communication solutions becomes paramount. Video conferencing and streaming services facilitate seamless interactions among teams, regardless of their physical locations. Recent data indicates that approximately 70% of French companies have integrated video solutions into their workflows, reflecting a shift towards digital collaboration. This trend is likely to continue, as businesses recognize the value of video in enhancing productivity and engagement. The enterprise video market is thus positioned to benefit from this growing reliance on remote collaboration tools, which are essential for maintaining operational efficiency in a dispersed workforce.

Technological Advancements in Video Solutions

Technological advancements are reshaping the enterprise video market in France, leading to the development of innovative video solutions. The integration of high-definition video, real-time analytics, and interactive features enhances user experience and engagement. Companies are increasingly adopting advanced video platforms that offer features such as live streaming, on-demand content, and virtual events. Recent reports indicate that the adoption of such technologies has increased by over 50% among French enterprises in the past year. This trend suggests that the enterprise video market is likely to expand as organizations seek to leverage cutting-edge technology to improve communication and collaboration.

Investment in Employee Training and Development

In France, the enterprise video market is significantly influenced by increased investment in employee training and development. Organizations are leveraging video content to deliver training programs that are both engaging and effective. The use of video allows for flexible learning opportunities, catering to diverse learning styles. Recent statistics suggest that around 60% of French enterprises utilize video for training purposes, indicating a strong preference for visual learning methods. This trend not only enhances employee skills but also contributes to higher retention rates. Consequently, the enterprise video market is likely to see sustained growth as companies prioritize video-based training solutions to foster a skilled workforce.