Integration with IoT Devices

The integration of video analytics with Internet of Things (IoT) devices is emerging as a pivotal driver in the Video Analytics Market. As IoT technology proliferates, the ability to connect video surveillance systems with various smart devices enhances data collection and analysis capabilities. This integration allows for more comprehensive monitoring and management of environments, from smart cities to industrial facilities. The market for IoT-enabled video analytics is projected to grow significantly, with estimates suggesting a value of USD 5 billion by 2025. This growth is fueled by the increasing demand for real-time insights and automation in various applications, including traffic management and environmental monitoring. Consequently, the synergy between video analytics and IoT devices is likely to propel the market forward.

Rising Demand for Security Solutions

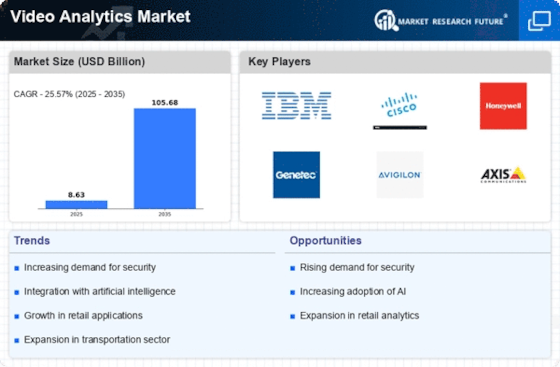

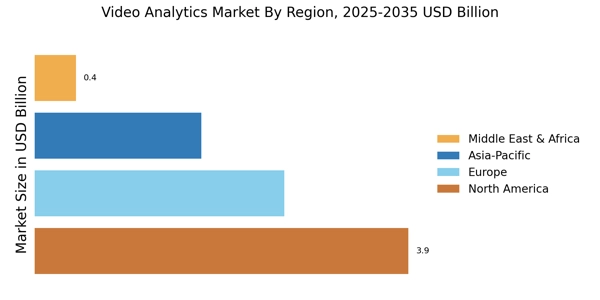

The Video Analytics Market is experiencing a notable surge in demand for advanced security solutions. As urbanization accelerates, cities are increasingly investing in surveillance systems to enhance public safety. According to recent data, The Video Analytics Market is projected to reach USD 75 billion by 2025, with video analytics playing a crucial role in this growth. The integration of AI and machine learning technologies into video analytics systems allows for real-time threat detection and response, thereby improving security measures. This trend is particularly evident in sectors such as retail, transportation, and critical infrastructure, where the need for enhanced security protocols is paramount. Consequently, the rising demand for security solutions is a significant driver of growth within the Video Analytics Market.

Regulatory Compliance and Data Privacy

Regulatory compliance and data privacy concerns are becoming increasingly critical in the Video Analytics Market. As governments implement stricter regulations regarding data protection, organizations must ensure that their video analytics solutions comply with these laws. This trend is particularly evident in regions where data privacy regulations are stringent, such as the European Union. Companies are investing in video analytics technologies that not only enhance security but also adhere to compliance standards. The market for compliant video analytics solutions is expected to grow as organizations prioritize data privacy in their operations. This focus on regulatory compliance is likely to drive innovation and development within the Video Analytics Market, as companies seek to balance security needs with legal obligations.

Advancements in AI and Machine Learning

Technological advancements in AI and machine learning are transforming the Video Analytics Market. These innovations enable systems to analyze vast amounts of video data with unprecedented accuracy and speed. For instance, AI algorithms can identify patterns and anomalies in real-time, facilitating proactive decision-making. The market for AI in video analytics is expected to grow at a compound annual growth rate of over 30% through 2025. This rapid growth is driven by the increasing need for automation and efficiency in various sectors, including retail, healthcare, and transportation. As organizations seek to leverage data for strategic insights, the integration of AI and machine learning into video analytics solutions becomes increasingly vital, thereby propelling the market forward.

Growing Need for Operational Efficiency

The Video Analytics Market is significantly influenced by the growing need for operational efficiency across various sectors. Organizations are increasingly recognizing the value of video analytics in optimizing processes and reducing costs. For example, in manufacturing, video analytics can monitor production lines to identify bottlenecks and improve workflow. This trend is reflected in the projected growth of the video analytics market, which is anticipated to reach USD 10 billion by 2025. By harnessing video data, businesses can make informed decisions that enhance productivity and streamline operations. As the demand for efficiency continues to rise, the adoption of video analytics solutions is likely to expand, further driving growth in the Video Analytics Market.