Growth in Automotive Sector

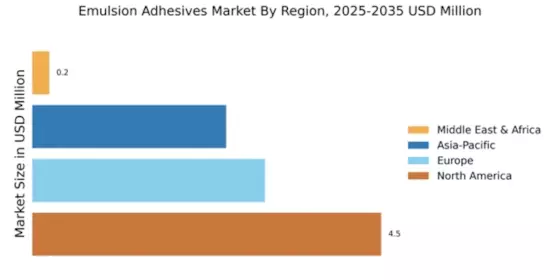

The automotive sector's expansion significantly influences the Global Emulsion Adhesives Market Industry. With the automotive industry increasingly adopting lightweight materials to enhance fuel efficiency, emulsion adhesives are becoming essential for bonding various components. This trend is likely to continue, as manufacturers prioritize performance and sustainability. The integration of advanced adhesive technologies in vehicle assembly processes suggests a growing reliance on these products. As a result, the market is expected to benefit from this sector's growth, contributing to the projected increase in market value to 20.3 USD Billion by 2035.

Sustainable Construction Practices

The increasing emphasis on sustainable construction practices appears to drive the Global Emulsion Adhesives Market Industry. As builders and manufacturers seek eco-friendly materials, emulsion adhesives, which are water-based and contain fewer volatile organic compounds, become more appealing. This shift aligns with global initiatives aimed at reducing carbon footprints and promoting sustainability. For instance, the demand for green building materials is projected to grow significantly, potentially enhancing the market's value. In 2024, the market is estimated to reach 12.5 USD Billion, indicating a robust interest in environmentally responsible products.

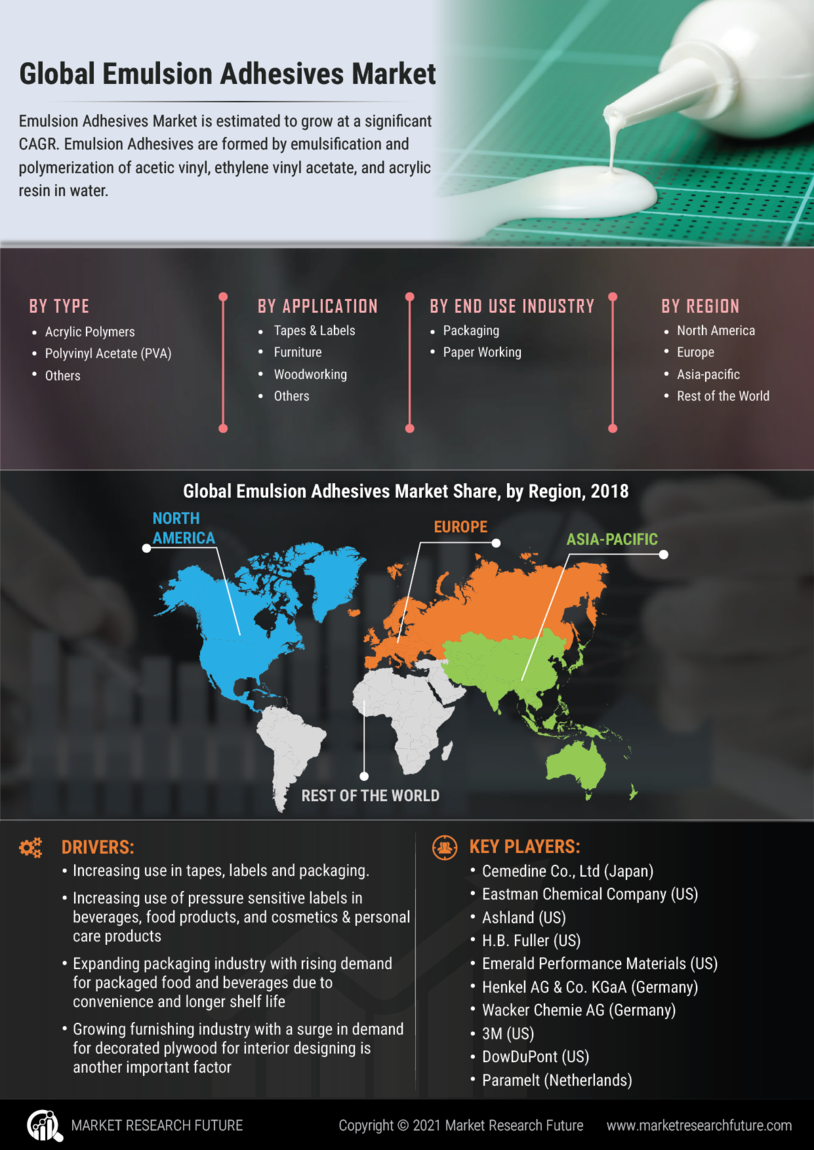

Rising Demand in Packaging Industry

The packaging industry's growth is a crucial driver for the Global Emulsion Adhesives Market Industry. As consumer preferences shift towards sustainable and recyclable packaging solutions, emulsion adhesives are increasingly favored for their eco-friendly properties. This trend is particularly evident in the food and beverage sector, where safety and compliance with regulations are paramount. The demand for efficient and reliable adhesive solutions in packaging applications is expected to rise, further boosting market growth. The anticipated increase in market value to 20.3 USD Billion by 2035 underscores the packaging industry's pivotal role in shaping the emulsion adhesives landscape.

Regulatory Support for Eco-Friendly Products

Regulatory support for eco-friendly products is becoming a significant driver for the Global Emulsion Adhesives Market Industry. Governments worldwide are implementing stringent regulations to limit the use of harmful chemicals in adhesives, thereby promoting water-based alternatives like emulsion adhesives. This regulatory landscape encourages manufacturers to innovate and develop compliant products that align with environmental standards. As a result, the market is likely to experience increased demand for these safer alternatives. The projected market value of 12.5 USD Billion in 2024 reflects the positive impact of such regulations on the industry's growth.

Technological Advancements in Adhesive Formulations

Technological advancements in adhesive formulations are likely to propel the Global Emulsion Adhesives Market Industry forward. Innovations in polymer chemistry and formulation techniques enable the development of high-performance emulsion adhesives that offer superior bonding strength and durability. These advancements cater to diverse applications across industries, including construction, automotive, and packaging. The introduction of specialized formulations that meet specific performance criteria may enhance market competitiveness. As manufacturers continue to invest in research and development, the market could witness a steady growth trajectory, potentially achieving a CAGR of 4.51% from 2025 to 2035.