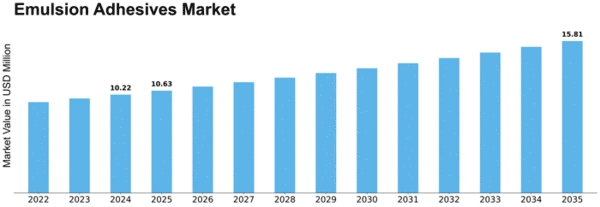

Emulsion Adhesives Size

Emulsion Adhesives Market Growth Projections and Opportunities

The Emulsion Adhesives Market is influenced by a range of factors that collectively shape its trends and growth dynamics. A key driver is the growing demand for eco-friendly and water-based adhesive solutions across various industries. Emulsion adhesives, characterized by their waterborne nature, low VOC emissions, and environmental sustainability, align with the increasing emphasis on green and sustainable manufacturing practices. As regulations on volatile organic compounds become more stringent and environmental awareness rises, the demand for emulsion adhesives continues to grow.

Global economic conditions play a pivotal role in the Emulsion Adhesives Market. Economic growth and industrialization contribute to increased manufacturing activities, fostering the need for adhesive solutions in packaging, automotive, construction, and textiles. Developing economies, in particular, drive the market's growth as they witness a surge in infrastructure development, consumer goods manufacturing, and packaging requirements.

Technological advancements in emulsion adhesive formulations impact the market dynamics. Ongoing research and development efforts lead to innovations that enhance the performance, adhesion properties, and versatility of emulsion adhesives. Companies that invest in these technological advancements gain a competitive edge by offering adhesive solutions with improved bonding strength, flexibility, and suitability for diverse substrates and applications.

Environmental considerations and regulatory measures are critical factors in the Emulsion Adhesives Market. With increasing awareness of the environmental impact of adhesive technologies, companies are pushed to adopt water-based emulsion adhesives to reduce their carbon footprint and comply with regulations. Emulsion adhesives, being free from hazardous solvents, contribute to a healthier working environment and meet regulatory standards, making them a preferred choice.

Geopolitical factors and trade dynamics also play a role in shaping the Emulsion Adhesives Market. Fluctuations in trade relations, changes in tariffs, and geopolitical tensions can impact the supply chain and pricing of emulsion adhesives. Companies need to stay informed about global trade developments and adjust their strategies to navigate potential risks and capitalize on emerging opportunities in the global market.

Furthermore, the packaging industry significantly contributes to the demand for Emulsion Adhesives. As the packaging sector experiences innovations in materials and design, the need for reliable and versatile adhesives grows. Emulsion adhesives find applications in various packaging formats, including carton sealing, labeling, and flexible packaging, contributing to their widespread adoption in the industry.

The construction sector is another key driver of the Emulsion Adhesives Market. Emulsion adhesives are used in various construction applications, such as bonding carpets, laminating flooring materials, and installing insulation. The ease of application, fast curing times, and environmental friendliness of emulsion adhesives make them suitable for construction projects where efficiency and sustainability are priorities.

The automotive industry significantly influences the Emulsion Adhesives Market. As automakers focus on lightweight materials and improved fuel efficiency, emulsion adhesives play a crucial role in bonding lightweight components and reducing overall vehicle weight. The automotive sector's demand for adhesive solutions that provide strength, flexibility, and durability contributes to the market's growth.

Raw material prices, particularly those of polymer emulsions and additives used in adhesive formulations, play a role in shaping the Emulsion Adhesives Market. Fluctuations in the costs of these raw materials impact the production costs and pricing of emulsion adhesives. Companies in the market must implement effective supply chain strategies and cost management practices to navigate these raw material price dynamics.

Leave a Comment