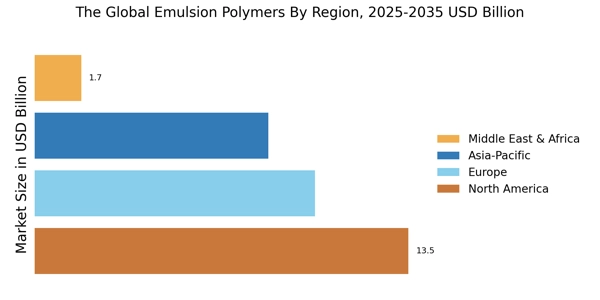

By Region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World.

Asia Pacific’s Emulsion Polymers Market share accounted for USD 10.7 billion in 2021 and is expected to exhibit a significant CAGR of 43.2 percent growth during the study period. The end-user sectors, including automotive, construction, electronics, and packaging, have been driving demand for goods like paints, coatings, and adhesives. India, Thailand, Vietnam, Pakistan, and Malaysia are just a few of the nations where the manufacture of automobiles has seen a noteworthy increase.

The largest auto manufacturer in the world, China, intends to create 2 million electric vehicles (EVs) annually by 2020 and 7 million annually by 2025. Moreover, China's emulsion polymers market held the largest market share, and the Indian emulsion polymers market was the fastest-growing market in the Asia-Pacific region.

Further, the major countries studied in the market report are The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

North America’s emulsion polymers market accounts for the second-largest market share. With the nation’s robust economy, favorable commercial real estate market fundamentals, and increased federal and state funding for infrastructure projects and institutional buildings, the construction industry in the United States has kept growing. The nation's expanding population is anticipated to increase housing demand. A further projection for the next ten years is the construction of around 20 million homes. Further, the U.S emulsion polymers market held the largest market share, and the Canadian emulsion polymers market was the fastest-growing market in the region.

The Europe Emulsion Polymers Market is expected to grow at the fastest CAGR from 2022 to 2030. The demand for commercial construction is predicted to increase, especially in countries like Germany, France, Russia, and Spain. This is largely because more people are using the product to improve the aesthetics of structures. Experts in the field predict that the demand for new homes will increase by 350,000 annually through 2020, which would help the building industry. During the projected period, there is expected to be strong growth potential for non-residential and commercial buildings in the nation.

Further, the German emulsion polymers market held the largest market share, and the UK emulsion polymers market was the fastest-growing market in the European region. In the Middle East and Africa, rapid urbanization and massive infrastructure projects in Saudi Arabia and the UAE are driving robust demand for high-performance architectural coatings. South America is witnessing steady growth fueled by a shift toward water-borne, low-VOC adhesives and sealants in the packaging and automotive sectors, particularly within the Brazilian market.