Increased Smartphone Penetration

The proliferation of smartphones globally is a pivotal driver for the Global Direct Carrier Billing Market Industry. As of 2024, the number of smartphone users is projected to reach approximately 4.3 billion, facilitating easier access to digital content and services. This trend indicates that consumers are increasingly inclined to utilize carrier billing for app purchases, subscriptions, and in-game transactions. The convenience of charging purchases directly to mobile accounts appeals to users, particularly in regions where credit card penetration remains low. Consequently, this growing smartphone adoption is expected to significantly contribute to the market's expansion.

Expansion of E-commerce Platforms

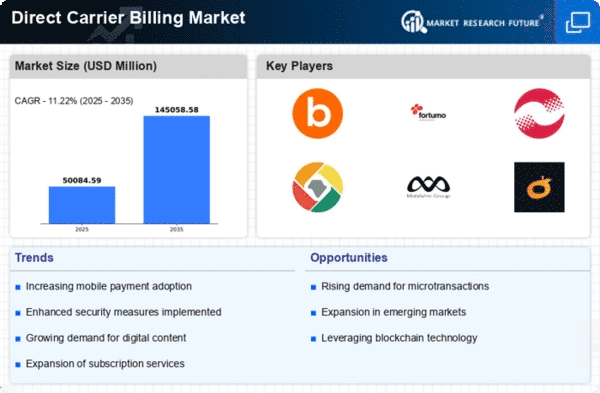

The rapid expansion of e-commerce platforms is significantly influencing the Global Direct Carrier Billing Market Industry. As online shopping becomes more prevalent, particularly in emerging markets, the need for diverse payment options is paramount. Direct carrier billing provides a convenient alternative for consumers who may lack access to credit cards or prefer not to use them. This payment method is particularly appealing for low-value transactions, which are common in e-commerce. With projections indicating a compound annual growth rate (CAGR) of 11.23% from 2025 to 2035, the integration of carrier billing into e-commerce platforms is expected to enhance user experience and drive market growth.

Rising Demand for Digital Content

The surging demand for digital content is a critical factor propelling the Global Direct Carrier Billing Market Industry. With the global digital content market projected to reach 45.0 USD Billion in 2024, consumers are increasingly seeking seamless payment solutions for streaming services, gaming, and app purchases. Direct carrier billing offers a frictionless payment experience, allowing users to access content without the need for traditional payment methods. This trend is particularly pronounced among younger demographics who favor mobile transactions. As the appetite for digital content continues to grow, the carrier billing model is likely to gain traction, enhancing market dynamics.

Integration with Emerging Technologies

The integration of emerging technologies such as blockchain and artificial intelligence is poised to transform the Global Direct Carrier Billing Market Industry. These technologies can enhance security, streamline payment processes, and improve user experience. For example, blockchain can provide transparent transaction records, while AI can personalize payment experiences based on user behavior. As these technologies become more prevalent, they may attract a broader audience to direct carrier billing solutions. This technological evolution could potentially lead to increased market penetration and consumer trust, thereby driving growth in the sector.

Regulatory Support for Mobile Payments

Regulatory support for mobile payment solutions is emerging as a significant driver for the Global Direct Carrier Billing Market Industry. Governments worldwide are increasingly recognizing the importance of mobile payments in fostering financial inclusion and economic growth. Initiatives aimed at promoting digital payment solutions are likely to create a favorable environment for direct carrier billing. For instance, regulations that simplify the onboarding process for mobile payment providers can enhance competition and innovation in the market. As regulatory frameworks evolve to support mobile payments, the direct carrier billing model is expected to gain further acceptance among consumers and merchants alike.