Research Methodology on Direct Carrier Billing Market

Introduction

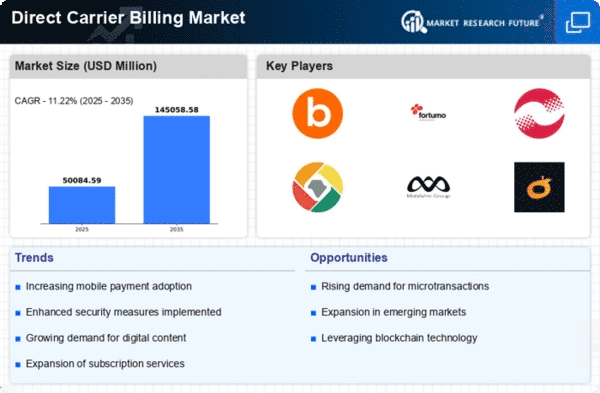

The Direct Carrier Billing Market provides insights into the imminent technologies, trends, and key players of the market. The Direct Carrier Billing Market is studied from the viewpoint of all its existing trends that affect the growth of the market, and it also identifies the opportunities for growth in the market. The report also provides a comprehensive analysis of the global Direct Carrier Billing Market and the market drivers and their impact on the market during the forecast period 2023 to 2030.

Research Methodology

The research methodology used for this study includes primary and secondary data sources, direct interviews, in-depth market analysis, consumer surveys and interviews, annual reports and publications, financial reports, and other industry sources. Primary data sources are used to obtain information on the overall market size, global market share, segment share, and competition. To get an accurate picture of the overall market, direct interviews with key players are conducted. In addition, industry experts are consulted to obtain insights into the drivers and restraints affecting the industry.

Secondary data is collected from global databases and publicly available resources, such as government websites, industry reports and publications, financial reports and other sources. Secondary data is used to validate primary data sources and to provide further information on market size and distributions.

Scope of the Study

The scope of the study is based on a comprehensive analysis of the global Direct Carrier Billing Market and its segments. The study takes into account market size, market share, market trends, geographical presence, value chain analysis and segmentation. Different aspects of the market such as drivers and restraints, technologies, key players and the industry outlook are also highlighted in the report. The report also provides an analysis of the competitive landscape, the approaches and strategies adopted by key players and their impact on the overall market dynamics.

Market Segmentation

The global Direct Carrier Billing Market is segmented by product type, application, business model, and region.

By product type, the market is segmented into digital goods, virtual items, PC/console game subscriptions, and others. The digital goods segment is expected to account for a larger share of the market.

By application, the market is segmented into mobile apps and games, online services and websites, and e-commerce. The mobile apps and games segment is expected to account for a larger share of the market.

By business model, the market is segmented into intermediated and direct billing. The intermediated segment is expected to account for a larger share of the market.

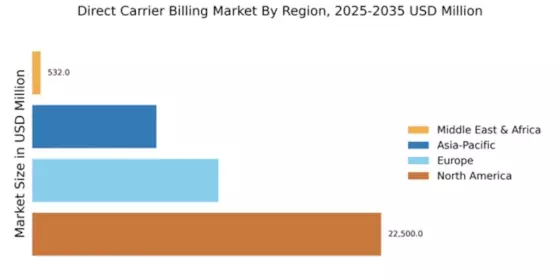

By region, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. North America is expected to account for the largest share of the market.

Key Players

Some of the key players in the global Direct Carrier Billing Market are Boku, Inc., Klarna AB, LGU+ Co. Ltd., AT&T Corporation, Apple, Inc., Verizon Wireless, Etisalat, Vodafone Group Plc., eBay Inc., Microsoft Corporation, and Amazon.com, Inc.

Competitive Landscape

The competitive landscape for the global Direct Carrier Billing Market is characterized by the presence of a large number of players. Key players are focusing on product innovation, strategic alliances and partnerships, and expansion of their product portfolio to gain an edge over other players in the market.

Conclusion

The research report indicates that the global Direct Carrier Billing Market is expected to grow at a steady growth rate during the forecast period 2023 to 2030. The market is driven by factors such as the increasing number of mobile subscribers and the increasing adoption of digital payments. The major players profiled in the report are Boku, Inc., Klarna AB, LGU+ Co. Ltd., AT&T Corporation, Apple, Inc., Verizon Wireless, Etisalat, Vodafone Group Plc., eBay Inc., Microsoft Corporation, and Amazon.com, Inc.

The key strategies adopted by these players to gain a competitive edge in the market include product innovation, strategic alliances and partnerships, and expansion of their product portfolio.