Rising Smartphone Penetration

The proliferation of smartphones is a key driver of the Mobile Money Market, as it enables a larger segment of the population to access mobile financial services. As of October 2025, smartphone penetration rates have reached approximately 80% in many regions, facilitating the use of mobile money applications. This trend is particularly pronounced in emerging markets, where mobile money serves as a primary banking solution for unbanked populations. The increasing availability of affordable smartphones is likely to further accelerate this trend, potentially leading to a 25% increase in mobile money transactions over the next few years. Consequently, the Mobile Money Market is poised for substantial growth as more users engage with mobile financial services.

Consumer Demand for Convenience

The Mobile Money Market is significantly influenced by consumer demand for convenience in financial transactions. As lifestyles become increasingly fast-paced, individuals are seeking quick and efficient ways to manage their finances. Mobile money services offer features such as instant transfers, bill payments, and easy access to funds, which align with consumer preferences for convenience. Recent surveys indicate that over 70% of users prefer mobile money solutions for their ease of use compared to traditional banking methods. This growing demand is likely to drive innovation and competition within the Mobile Money Market, as providers strive to enhance user experience and meet evolving consumer expectations.

Regulatory Support and Frameworks

The Mobile Money Market benefits from supportive regulatory frameworks that encourage innovation and protect consumers. Governments are increasingly recognizing the importance of mobile money in promoting financial inclusion and economic growth. For instance, several countries have implemented regulations that facilitate easier onboarding processes for mobile money providers, thereby expanding market access. In 2025, it is estimated that regulatory changes will lead to a 15% increase in the number of registered mobile money accounts. This regulatory support not only fosters competition but also enhances consumer confidence, which is essential for the sustained growth of the Mobile Money Market.

Partnerships with Financial Institutions

Strategic partnerships between mobile money providers and financial institutions are emerging as a crucial driver for the Mobile Money Market. These collaborations enable mobile money services to leverage the existing infrastructure and expertise of traditional banks, thereby enhancing service offerings. For instance, partnerships can facilitate access to credit and savings products for mobile money users, broadening the scope of financial services available. As of October 2025, it is projected that such partnerships will contribute to a 20% increase in the number of mobile money transactions, as users gain access to a wider array of financial products. This synergy between mobile money and traditional banking is likely to strengthen the overall Mobile Money Market.

Technological Advancements in Mobile Payments

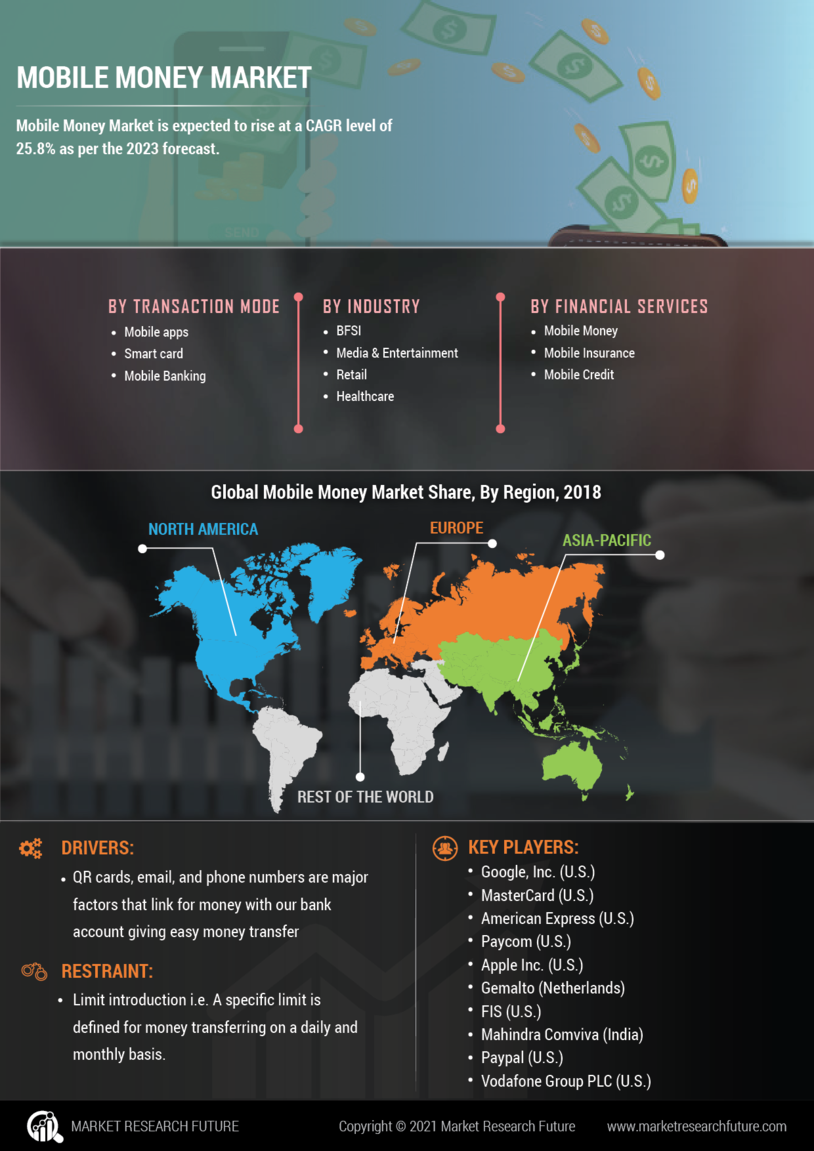

The Mobile Money Market is experiencing a surge in technological advancements that enhance payment processing efficiency. Innovations such as Near Field Communication (NFC) and QR code payments are becoming increasingly prevalent, allowing users to conduct transactions seamlessly. According to recent data, the adoption of NFC technology has increased by over 30% in the last year, indicating a strong consumer preference for contactless payments. Furthermore, the integration of artificial intelligence in fraud detection is bolstering security measures, which is crucial for user trust. As these technologies evolve, they are likely to drive further growth in the Mobile Money Market, attracting both consumers and businesses seeking efficient payment solutions.