Rising Need for Cost Efficiency

The Digital Transaction Management Market (DTM) Market is witnessing an increasing emphasis on cost efficiency among organizations. As businesses strive to optimize their operational expenditures, the adoption of DTM solutions presents a viable pathway to reduce costs associated with paper-based processes. By transitioning to digital transactions, companies can minimize printing, storage, and shipping expenses. Recent studies suggest that organizations implementing DTM solutions can achieve cost savings of up to 30% annually. This financial incentive is driving the adoption of DTM technologies, as companies recognize the potential for improved profitability and resource allocation. Consequently, the DTM market is likely to expand as more organizations seek to leverage digital solutions to enhance their financial performance.

Increased Focus on Customer Experience

The Digital Transaction Management Market (DTM) Market is increasingly prioritizing customer experience as a key driver of growth. Organizations recognize that providing a seamless and efficient transaction process is essential for customer satisfaction and retention. As consumers demand faster, more convenient digital interactions, businesses are compelled to adopt DTM solutions that enhance the overall customer journey. This shift is reflected in the growing investment in user-friendly interfaces and mobile accessibility within DTM platforms. Market data suggests that companies that prioritize customer experience through effective DTM solutions are likely to see higher customer loyalty and increased revenue. As a result, the DTM market is expected to flourish as organizations strive to meet evolving customer expectations and improve their service delivery.

Growing Demand for Remote Work Solutions

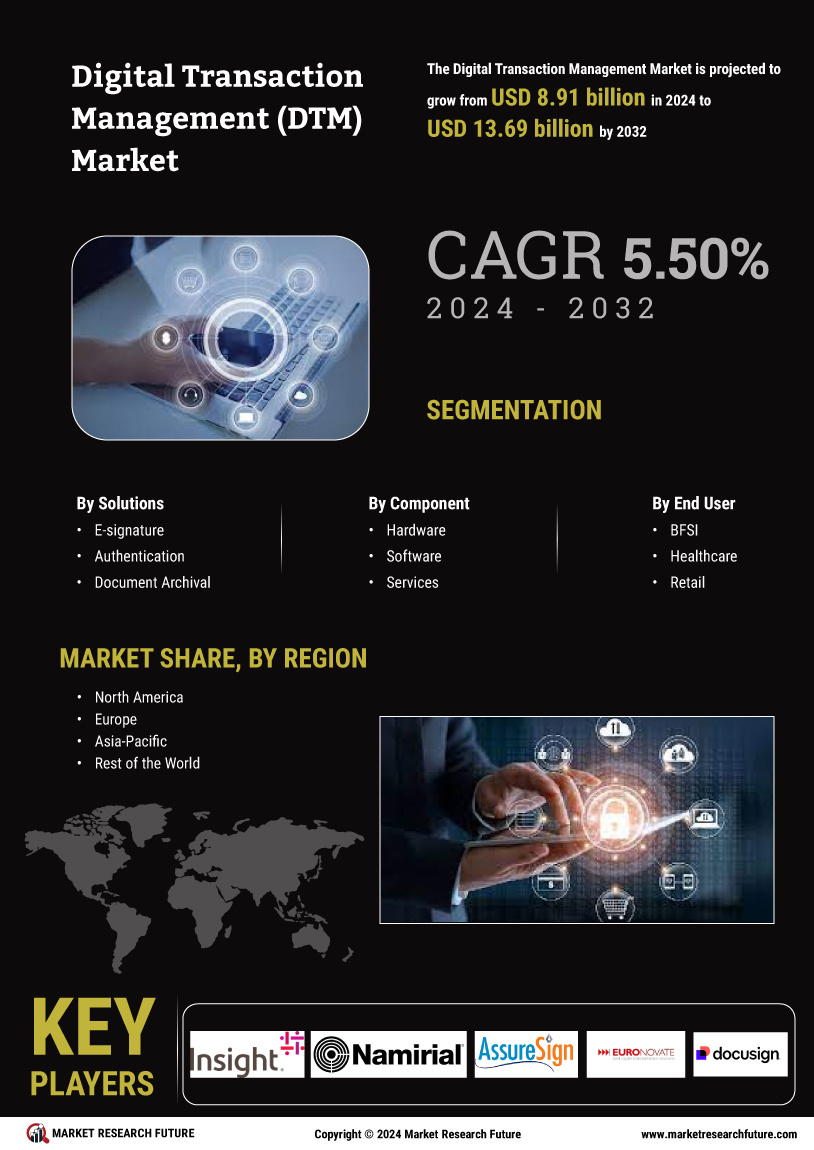

The Digital Transaction Management Market (DTM) Market is experiencing a notable surge in demand for solutions that facilitate remote work. As organizations increasingly adopt flexible work arrangements, the need for efficient digital transaction processes becomes paramount. This shift is evidenced by a significant rise in the use of electronic signatures and document management systems, which streamline workflows and enhance productivity. According to recent data, the DTM market is projected to grow at a compound annual growth rate of approximately 20% over the next five years. This growth is driven by the necessity for businesses to maintain operational continuity while ensuring compliance with regulatory standards. Consequently, the DTM market is likely to expand as companies seek to implement robust digital solutions that support remote collaboration and secure transactions.

Regulatory Compliance and Legal Frameworks

The Digital Transaction Management Market (DTM) Market is significantly influenced by the evolving landscape of regulatory compliance and legal frameworks. Organizations are increasingly required to adhere to stringent regulations regarding data protection and electronic transactions. This has led to a heightened focus on DTM solutions that ensure compliance with laws such as the General Data Protection Regulation (GDPR) and the Electronic Signatures in Global and National Commerce (ESIGN) Act. As businesses navigate these complex legal requirements, the demand for DTM solutions that offer secure, compliant transaction processes is expected to rise. Market data indicates that companies investing in DTM technologies are likely to experience reduced legal risks and enhanced operational efficiency, further propelling the growth of the DTM market.

Technological Advancements in Digital Solutions

The Digital Transaction Management Market (DTM) Market is significantly shaped by rapid technological advancements in digital solutions. Innovations such as blockchain technology, artificial intelligence, and machine learning are transforming the way transactions are managed and executed. These technologies enhance the security, speed, and efficiency of digital transactions, making them more appealing to businesses. For instance, the integration of AI in DTM solutions can automate routine tasks, thereby reducing human error and increasing productivity. Market analysts project that the incorporation of advanced technologies will drive the DTM market's growth, as organizations seek to adopt cutting-edge solutions that provide a competitive edge in their operations. This trend indicates a promising future for the DTM market as it evolves alongside technological progress.