Research Methodology on Digital Transaction Management Market

ABSTRACT

This research report provides a detailed overview of the Digital Transaction Management market and its current position in the global market. The research methodologies and strategies used for the estimation and forecasting of this market are also discussed. This research report is divided into four sections, namely, introduction, market overview and key services and trends, market estimation and forecast and competitive analysis.

INTRODUCTION

Digital Transaction Management (DTM) refers to the use of computerized systems to store, process, and manage financial transactions. This includes transactions related to payments, transfers, investments, and other financial activities. It is important to note that digital transaction management offers a secure, efficient, and paperless method of conducting financial activities that are otherwise inconvenient and subject to error-prone manual procedures. Additionally, this technology helps eliminate the need for costly and time-consuming paper-based processes.

The digital transaction management market is growing rapidly due to advances in technology and the increasing popularity of e-commerce and mobile payments. Additionally, the implementation of the BBVA Open Banking model and the accelerated use of contactless payment methods across the globe are some of the other factors that have been driving the growth of the market.

MARKET OVERVIEW AND KEY SERVICES AND TRENDS

The digital transaction management market is estimated to reach its all-time high revenue figure, owing to the implementation of advanced technologies and customer requirements for efficient and secure services. Many companies are engaging in the development of digital transaction management solutions that have the potential to facilitate customer experience without compromising on security. The growing demand for digital transaction management solutions has led to the emergence of several players in the market. Companies are focusing on the development of cost-effective and secure transactions that can enable organizations to effectively manage their finances.

A key trend in the digital transaction management market is the increased adoption of blockchain technology. Blockchain-based solutions are being used to facilitate secure transactions, eliminate the need for intermediaries, and reduce costs associated with legal processes. This technology enables companies to implement digital transaction management solutions with great accuracy and transparency. Additionally, these solutions are used to ensure compliance with financial regulations, reduce fraud and identity theft, and increase security.

Another major trend in the digital transaction management market is the adoption of mobile applications. These applications enable customers to securely send and receive payments, manage their finances, and carry out other activities with ease. Additionally, mobile applications help eliminate the need for bulky processes and tedious paperwork, allowing customers to conveniently manage their finances.

MARKET ESTIMATION AND FORECAST

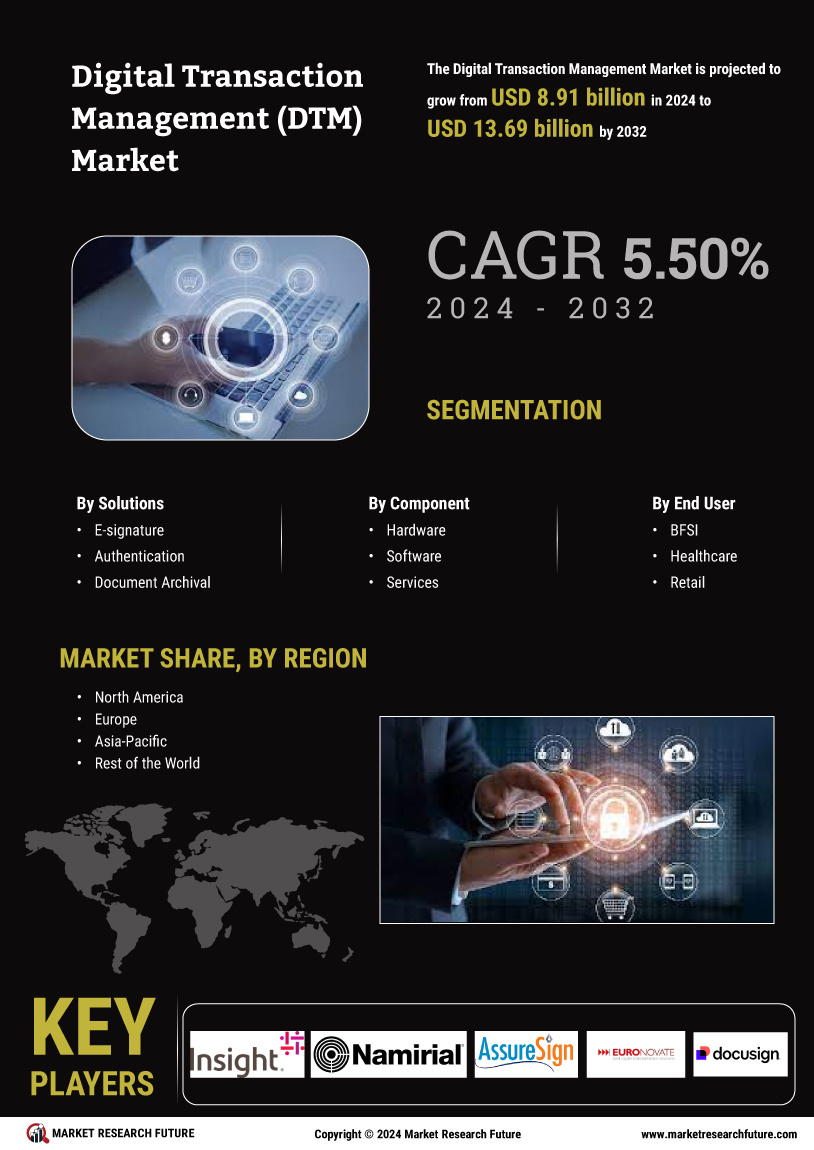

The Digital Transaction Management market is estimated to grow at a steady CAGR during the forecast period 2023-2030. The market is driven by the increasing demand for secure and cost-effective transactions, advanced technologies, the proliferation of e-commerce, and the growing demand for customer experience.

The market is segmented based on platform, services, end-user, and region. On the basis of platform, the market is divided into cloud, on-premise, and hybrid. On the basis of services, the market is segregated into software and service offerings. On the basis of end-user, the market is divided into banking, finance, investment, healthcare, telecommunication, retail, and others.

REGIONAL ANALYSIS

Regional Analysis of the Digital Transaction Management market has been conducted for North America, Europe, Asia-Pacific, and the Rest of the World. According to the study, North America is estimated to account for the largest share of the global market during the forecast period 2023 to 2030. The growth of this region is attributed to the presence of several major companies offering digital transaction management solutions, increasing investments in advanced technologies, and the widespread adoption of cloud-enabled solutions.

COMPETITIVE ANALYSIS

This research report provides an in-depth analysis of the competitive landscape of the Digital Transaction Management market. The player's market revenue, financial analysis, SWOT analysis, market strategies, and developments are discussed in the report. The key players profiled in this market are Adobe, IBM Corporation, SAP SE, Fiserv, Inc., OpenText Corporation, Oracle Corporation, BNP Paribas, Experian PLC, B2 Group, and EVO Payments International.

RESEARCH METHODOLOGY

This research report is based on a comprehensive research methodology in order to provide a detailed overview of the digital transaction management market. The research underpinned in this research report involves extensive secondary research and in-depth primary research.

The secondary sources of information used in this research include published journals, articles, and market research reports from reliable sources such as Factiva, S&P Capital IQ, Hoover's, and OneSource. In addition to this, information was also collected through interviews with experts, industry veterans, and market watchers to provide an in-depth understanding of the market dynamics, trends, and opportunities. Furthermore, market information was derived through the analysis of various international and regional organizations.

The primary sources of data and information used for this research include primary interviews with key players in the digital transaction management industry as well as surveys of consumers and end-users. For the primary survey, questionnaires were designed and sent to key opinion leaders to capture the responses from industry players and service providers.

The research was conducted in a four-step methodology: data collection, data analysis, data validation, and data integration. The collected data were analyzed and validated against industry standards to ensure accuracy and completeness. The collected data were also integrated to provide an overall picture of the digital transaction management market. Finally, the market size and forecast were done by taking into consideration several parameters such as market trends and dynamics, competitive landscape, and consumer behaviour.