Regulatory Landscape Evolution

The evolving regulatory landscape in South Korea plays a pivotal role in shaping the transaction monitoring market. With the government implementing stricter anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, financial institutions are compelled to enhance their monitoring capabilities. As of 2025, the Financial Services Commission has mandated that banks and financial entities invest in advanced transaction monitoring systems to ensure compliance. This regulatory push is expected to drive market growth, as institutions allocate approximately 15% of their IT budgets towards compliance-related technologies. The transaction monitoring market is thus positioned to benefit from these regulatory requirements, as firms seek to avoid hefty fines and reputational damage associated with non-compliance.

Increased Cybersecurity Threats

The rise in cybersecurity threats has emerged as a critical driver for the transaction monitoring market in South Korea. With cybercriminals employing increasingly sophisticated tactics, financial institutions are under pressure to bolster their security measures. In 2025, it is estimated that cyberattacks on financial services could lead to losses exceeding $1 billion in South Korea alone. Consequently, organizations are investing heavily in transaction monitoring solutions that incorporate robust cybersecurity features. This focus on safeguarding sensitive financial data is likely to propel the transaction monitoring market, as firms seek to mitigate risks associated with cyber threats and protect their customers.

Consumer Demand for Transparency

Consumer demand for transparency in financial transactions is reshaping the transaction monitoring market in South Korea. As customers become more aware of their rights and the importance of secure transactions, they expect financial institutions to provide clear insights into their transaction processes. This shift in consumer behavior is prompting banks and fintech companies to adopt more transparent transaction monitoring practices. By 2025, it is anticipated that 70% of consumers will prefer institutions that demonstrate a commitment to transparency and security. This growing expectation is likely to drive the transaction monitoring market, as firms strive to enhance their monitoring systems to meet consumer demands.

Expansion of Digital Payment Systems

The rapid expansion of digital payment systems in South Korea is significantly impacting the transaction monitoring market. With the increasing adoption of mobile wallets and online payment platforms, the volume of transactions is surging. In 2025, it is projected that digital payment transactions will account for over 50% of all financial transactions in the country. This surge necessitates advanced transaction monitoring solutions to effectively manage and analyze the growing data flow. Financial institutions are thus investing in sophisticated monitoring systems to ensure compliance and mitigate risks associated with digital transactions. This trend is expected to drive substantial growth in the transaction monitoring market.

Technological Advancements in Analytics

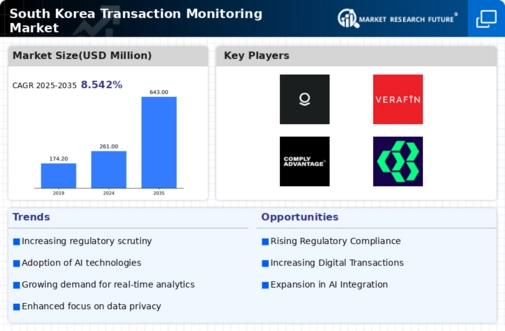

Technological advancements in analytics are significantly influencing the transaction monitoring market in South Korea. The integration of artificial intelligence (AI) and machine learning (ML) into transaction monitoring systems allows for more sophisticated data analysis and anomaly detection. As organizations increasingly adopt these technologies, the market is projected to grow at a CAGR of 12% from 2025 to 2030. Enhanced analytics capabilities enable financial institutions to process vast amounts of transaction data in real-time, improving their ability to identify suspicious activities. This trend not only streamlines compliance efforts but also enhances overall operational efficiency, making it a crucial driver for the transaction monitoring market.