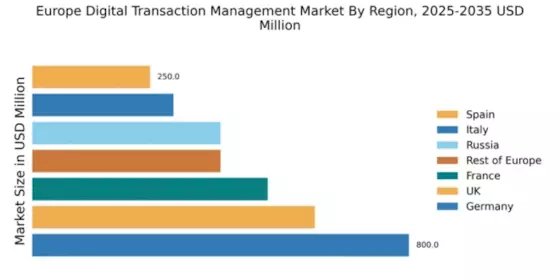

Germany : Strong Growth in E-signatures

Germany holds a dominant position in the European digital transaction-management market, accounting for 32% of the total market share with a value of $800.0 million. Key growth drivers include the increasing adoption of e-signatures in various sectors, supported by robust regulatory frameworks like the eIDAS regulation. The demand for digital solutions is further fueled by the push for digital transformation across industries, alongside government initiatives promoting paperless transactions. Infrastructure development, particularly in urban centers, enhances accessibility and efficiency in digital transactions.

UK : Innovation and Compliance Drive Growth

The UK digital transaction-management market is valued at $600.0 million, representing 24% of the European market. Growth is driven by the increasing need for secure and compliant digital solutions, particularly in finance and legal sectors. The UK government has implemented policies to encourage digital adoption, including the Digital Economy Act. The demand for e-signatures is rising as businesses seek to streamline operations and enhance customer experiences, particularly in urban areas like London and Manchester.

France : E-signatures Gaining Popularity

France's digital transaction-management market is valued at $500.0 million, capturing 20% of the European market. The growth is propelled by the increasing acceptance of e-signatures in both public and private sectors, supported by the French Digital Law. Demand trends indicate a shift towards digital solutions in industries such as real estate and healthcare. Major cities like Paris and Lyon are leading the charge in adopting these technologies, with a focus on enhancing operational efficiency and customer satisfaction.

Russia : Regulatory Changes Boost Adoption

Russia's digital transaction-management market is valued at $400.0 million, accounting for 16% of the European market. Key growth drivers include recent regulatory changes that facilitate the use of e-signatures, alongside a growing demand for digital solutions in sectors like banking and e-commerce. Cities such as Moscow and St. Petersburg are pivotal in this transformation, with local businesses increasingly adopting digital transaction solutions to improve efficiency and compliance with new regulations.

Italy : E-signatures Transforming Business Practices

Italy's digital transaction-management market is valued at $300.0 million, representing 12% of the European market. The growth is driven by the increasing need for efficient and secure transaction methods, particularly in the legal and financial sectors. Government initiatives, such as the Digital Agenda for Italy, are promoting the adoption of e-signatures. Key markets include Milan and Rome, where businesses are rapidly integrating digital solutions to enhance operational efficiency and customer engagement.

Spain : Digital Transformation Accelerates

Spain's digital transaction-management market is valued at $250.0 million, making up 10% of the European market. The growth is fueled by the increasing demand for digital solutions across various sectors, particularly in real estate and finance. The Spanish government has introduced initiatives to support digital transformation, including the Digital Spain 2025 agenda. Major cities like Madrid and Barcelona are at the forefront of adopting e-signature technologies, enhancing business efficiency and customer service.

Rest of Europe : Varied Adoption Across Regions

The Rest of Europe digital transaction-management market is valued at $400.0 million, accounting for 16% of the total market. Growth drivers include varying levels of digital adoption across countries, influenced by local regulations and market needs. Countries like the Netherlands and Sweden are leading in e-signature adoption, while others are catching up. The competitive landscape features both local and international players, with a focus on sector-specific applications in finance, healthcare, and logistics.