Rising Cybersecurity Threats

The transaction monitoring market is increasingly influenced by the rise in cybersecurity threats. Financial institutions in the UK are facing a growing number of cyberattacks, which pose significant risks to their operations and customer data. As a response, there is a pressing need for enhanced transaction monitoring systems that can identify and mitigate these threats. The UK government has reported a 40% increase in cybercrime incidents over the past year, prompting organizations to prioritize cybersecurity measures. This trend is likely to drive investments in transaction monitoring solutions that incorporate advanced security features. By integrating cybersecurity protocols into their monitoring systems, financial institutions can better protect themselves and their customers, thereby fostering trust and stability in the transaction monitoring market.

Shift Towards Digital Banking

The shift towards digital banking is reshaping the transaction monitoring market. As more consumers and businesses opt for online banking solutions, the volume of digital transactions is surging. This trend necessitates the implementation of robust transaction monitoring systems to ensure the security and integrity of these transactions. Recent statistics indicate that digital banking transactions in the UK have increased by over 50% in the last two years. Consequently, financial institutions are compelled to enhance their monitoring capabilities to address the complexities associated with digital transactions. The transaction monitoring market is likely to benefit from this shift, as organizations invest in technologies that can effectively monitor and analyze digital transactions in real-time, ensuring compliance and reducing the risk of fraud.

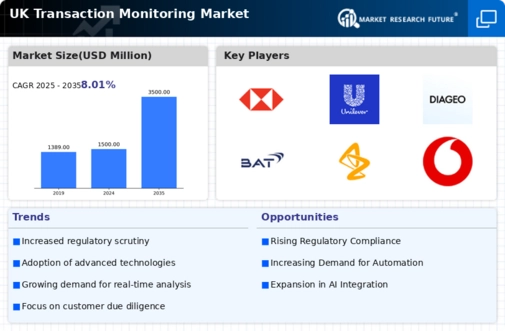

Increasing Regulatory Scrutiny

The transaction monitoring market is experiencing heightened regulatory scrutiny, particularly in the UK. Regulatory bodies are imposing stricter compliance requirements on financial institutions to combat money laundering and fraud. This has led to a surge in demand for advanced transaction monitoring solutions that can effectively detect suspicious activities. According to recent data, the UK financial sector has seen a 30% increase in compliance-related expenditures over the past year. As a result, firms are investing in sophisticated technologies to ensure adherence to regulations, thereby driving growth in the transaction monitoring market. The need for robust monitoring systems is further underscored by the potential penalties for non-compliance, which can reach millions of pounds, making it imperative for organizations to prioritize their transaction monitoring capabilities.

Consumer Demand for Transparency

Consumer demand for transparency is becoming a pivotal driver in the transaction monitoring market. As customers become more aware of financial fraud and data breaches, they are increasingly seeking assurance that their transactions are being monitored effectively. This shift in consumer expectations is prompting financial institutions to adopt more transparent transaction monitoring practices. According to surveys, approximately 70% of UK consumers express a preference for banks that provide clear information about their monitoring processes. In response, organizations are likely to enhance their communication strategies and invest in technologies that allow for greater visibility into transaction monitoring activities. This trend not only fosters customer trust but also drives growth in the transaction monitoring market as institutions strive to meet evolving consumer demands.

Technological Advancements in Monitoring Solutions

Technological advancements are significantly influencing the transaction monitoring market. Innovations such as artificial intelligence (AI) and machine learning (ML) are being integrated into monitoring solutions, enhancing their ability to analyze vast amounts of transaction data in real-time. This evolution allows for more accurate detection of fraudulent activities and reduces false positives, which can be a major challenge for financial institutions. The transaction monitoring market is projected to grow by approximately 25% over the next five years, driven by these technological improvements. As organizations seek to leverage these advancements, they are likely to invest heavily in upgrading their monitoring systems, thereby propelling the market forward. The adoption of cloud-based solutions is also on the rise, offering scalability and flexibility to meet the dynamic needs of the industry.