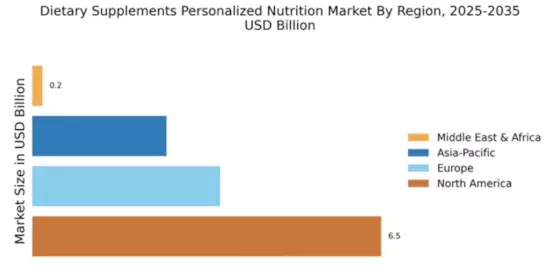

North America : Market Leader in Nutrition

North America is poised to maintain its leadership in the Dietary Supplements Personalized Nutrition Market, holding a market size of $6.5B in 2025. The region's growth is driven by increasing health awareness, a rise in chronic diseases, and a growing preference for personalized health solutions. Regulatory support from agencies like the FDA further enhances market dynamics, ensuring product safety and efficacy, which boosts consumer confidence. The competitive landscape is robust, with key players such as Herbalife, Amway, and GNC Holdings leading the charge. The U.S. is the primary market, accounting for a significant share, while Canada and Mexico also contribute to growth. The presence of established brands and innovative startups fosters a dynamic environment, catering to diverse consumer needs and preferences, thus solidifying North America's market position.

Europe : Emerging Market Potential

Europe's Dietary Supplements Personalized Nutrition Market is projected to reach $3.5B by 2025, driven by increasing consumer demand for tailored health solutions and a growing focus on preventive healthcare. Regulatory frameworks, such as the EU's Novel Food Regulation, are pivotal in shaping the market, ensuring that products meet safety and efficacy standards, which enhances consumer trust and market growth. Leading countries in this region include Germany, France, and the UK, where health-conscious consumers are increasingly seeking personalized nutrition options. The competitive landscape features major players like Bayer AG and Nestle, alongside numerous local brands. This diversity fosters innovation and competition, catering to a wide range of dietary preferences and health needs, thus propelling the market forward.

Asia-Pacific : Rapid Growth and Innovation

The Asia-Pacific region is witnessing rapid growth in the Dietary Supplements Personalized Nutrition Market, projected to reach $2.5B by 2025. Factors such as rising disposable incomes, increasing health awareness, and a growing aging population are driving demand for personalized nutrition solutions. Regulatory bodies are also becoming more proactive in establishing guidelines that support market growth and consumer safety, enhancing the overall market environment. Countries like China, Japan, and India are at the forefront of this growth, with a burgeoning middle class increasingly investing in health and wellness products. The competitive landscape is characterized by both global giants and local players, fostering innovation and a diverse product offering. Key players such as Abbott Laboratories and Herbalife are expanding their presence, catering to the unique dietary needs of consumers in this diverse region.

Middle East and Africa : Untapped Market Opportunities

The Middle East and Africa (MEA) region represents an untapped market for Dietary Supplements Personalized Nutrition, with a market size of $0.19B projected for 2025. The growth is driven by increasing health awareness, rising disposable incomes, and a shift towards preventive healthcare. Regulatory frameworks are gradually evolving, with governments recognizing the importance of dietary supplements in public health, which is expected to catalyze market growth in the coming years. Countries like South Africa and the UAE are leading the charge, with a growing number of consumers seeking personalized nutrition solutions. The competitive landscape is still developing, with both international and local brands vying for market share. As awareness and demand increase, key players are likely to invest more in this region, paving the way for significant growth and innovation in the personalized nutrition sector.