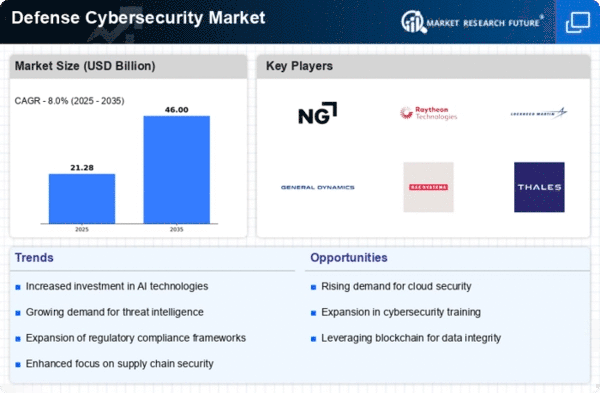

The Defense Cybersecurity Market is characterized by a dynamic competitive landscape, driven by the increasing sophistication of cyber threats and the growing need for robust defense mechanisms. Major players such as Northrop Grumman (US), Raytheon Technologies (US), and Lockheed Martin (US) are at the forefront, each adopting distinct strategies to enhance their market positioning. Northrop Grumman (US) emphasizes innovation through advanced technologies, particularly in artificial intelligence and machine learning, to bolster its cybersecurity offerings. Meanwhile, Raytheon Technologies (US) focuses on strategic partnerships and collaborations to expand its capabilities and reach. Lockheed Martin (US) is heavily investing in digital transformation initiatives, aiming to integrate cutting-edge technologies into its cybersecurity solutions, thereby enhancing operational efficiency and effectiveness.The market structure appears moderately fragmented, with a mix of established players and emerging firms vying for market share. Key business tactics such as localizing manufacturing and optimizing supply chains are prevalent among these companies, allowing them to respond swiftly to regional demands and enhance service delivery. The collective influence of these major players shapes the competitive environment, fostering a climate of innovation and strategic collaboration.

In November Northrop Grumman (US) announced a partnership with a leading cloud service provider to enhance its cybersecurity solutions for defense clients. This strategic move is likely to bolster Northrop Grumman's capabilities in cloud security, addressing the increasing demand for secure cloud environments in defense operations. Such partnerships may also facilitate the integration of advanced technologies, positioning the company favorably in a rapidly evolving market.

In October Raytheon Technologies (US) unveiled a new cybersecurity platform designed to protect critical infrastructure from emerging cyber threats. This initiative underscores the company's commitment to innovation and its proactive approach to addressing the evolving landscape of cyber threats. By focusing on critical infrastructure, Raytheon Technologies is likely to capture a significant share of the market, as governments and organizations prioritize the protection of essential services.

In September Lockheed Martin (US) launched a comprehensive cybersecurity training program aimed at enhancing the skills of defense personnel. This initiative reflects the company's recognition of the importance of human capital in cybersecurity. By investing in training, Lockheed Martin not only strengthens its workforce but also contributes to the overall resilience of defense cybersecurity, potentially setting a benchmark for industry standards.

As of December current trends in the Defense Cybersecurity Market indicate a strong emphasis on digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are increasingly shaping the competitive landscape, enabling companies to leverage complementary strengths and enhance their offerings. Looking ahead, competitive differentiation is expected to evolve, with a shift from price-based competition to a focus on innovation, technology, and supply chain reliability. This transition may redefine how companies position themselves in the market, emphasizing the need for agility and responsiveness to emerging threats.