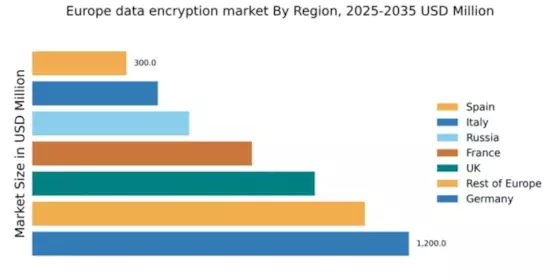

Germany : Strong Demand and Innovation Hub

Germany holds a dominant position in the European data encryption market, accounting for 24% of the total market share with a value of $1,200.0 million. Key growth drivers include stringent data protection regulations like the GDPR, which have heightened demand for encryption solutions. The increasing digitization of industries and a focus on cybersecurity are also pivotal. Government initiatives promoting digital infrastructure further bolster market growth, making Germany a leader in technological advancements.

UK : Innovation and Compliance Drive Demand

The UK data encryption market is valued at $900.0 million, representing 18% of the European market. Growth is fueled by rising cyber threats and compliance with regulations such as the Data Protection Act. The demand for encryption solutions is particularly strong in finance and healthcare sectors, where data security is paramount. The UK government’s investment in cybersecurity initiatives enhances the market landscape, fostering innovation and adoption of advanced encryption technologies.

France : Regulatory Framework Fuels Growth

France's data encryption market is valued at $700.0 million, capturing 14% of the European market. The growth is driven by the implementation of the GDPR and national cybersecurity strategies that mandate data protection measures. Increasing awareness of data breaches among businesses is pushing demand for encryption solutions. The French government’s support for tech startups in cybersecurity is also a significant factor in market expansion, enhancing local innovation.

Russia : Regulatory Changes Impact Market Dynamics

Russia's data encryption market is valued at $500.0 million, accounting for 10% of the European market. Key growth drivers include the increasing need for data protection in both public and private sectors, driven by new regulations on data localization. However, geopolitical tensions and economic sanctions pose challenges. Major cities like Moscow and St. Petersburg are central to market activities, with local players like Kaspersky leading the competitive landscape.

Italy : Focus on Compliance and Innovation

Italy's data encryption market is valued at $400.0 million, representing 8% of the European market. The growth is propelled by the need for compliance with GDPR and increasing cyber threats. The Italian government is actively promoting cybersecurity initiatives, which are enhancing the demand for encryption solutions. Key markets include Milan and Rome, where major players like Thales and IBM are establishing a strong presence, driving local innovation and competition.

Spain : Investment in Cybersecurity Solutions

Spain's data encryption market is valued at $300.0 million, making up 6% of the European market. The growth is driven by rising awareness of data security and compliance with EU regulations. The Spanish government is investing in cybersecurity infrastructure, which is fostering demand for encryption technologies. Key cities like Madrid and Barcelona are pivotal markets, with local firms and international players like Cisco competing for market share.

Rest of Europe : Varied Demand Across Regions

The Rest of Europe data encryption market is valued at $1,060.0 million, accounting for 21% of the total market. This segment includes diverse markets with varying regulatory environments and demand patterns. Growth is driven by localized data protection laws and increasing cyber threats across sectors. Countries like the Netherlands and Belgium are notable for their advanced cybersecurity frameworks, with major players like Gemalto and McAfee actively participating in these markets.