Increased Cloud Adoption

The surge in cloud adoption among businesses in the GCC is significantly influencing the data encryption market. As organizations migrate to cloud-based services, the need for securing data in transit and at rest becomes paramount. In 2025, it is anticipated that cloud spending in the region will exceed $10 billion, with a substantial focus on security solutions, including encryption. This trend suggests that companies are increasingly aware of the vulnerabilities associated with cloud storage and are seeking encryption technologies to protect their data. Consequently, the data encryption market is likely to benefit from this shift towards cloud services, as organizations prioritize data security in their cloud strategies.

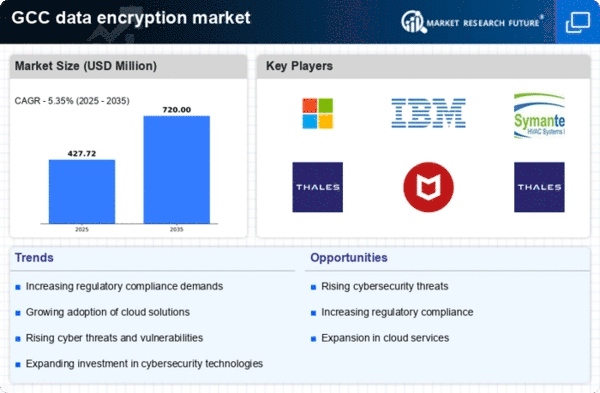

Rising Cybersecurity Threats

The data encryption market is experiencing growth due to the escalating threats posed by cybercriminals. As organizations in the GCC face increasing incidents of data breaches and ransomware attacks, the demand for robust encryption solutions intensifies. In 2025, it is estimated that the cybersecurity market in the region will reach approximately $20 billion, with a significant portion allocated to encryption technologies. This trend indicates that businesses are prioritizing data protection measures to safeguard sensitive information. Consequently, The data encryption market is likely to expand. Companies are seeking to implement advanced encryption protocols to mitigate risks associated with unauthorized access and data loss.

Growing Awareness of Data Privacy

The heightened awareness of data privacy among consumers and businesses in the GCC is driving the data encryption market. With the implementation of stringent data protection regulations, organizations are compelled to adopt encryption solutions to ensure compliance and build trust with their customers. In 2025, it is estimated that the data protection market in the region will grow by 15%, reflecting the increasing emphasis on safeguarding personal information. This awareness encourages businesses to invest in encryption technologies as a fundamental component of their data protection strategies. As a result, the data encryption market is expected to expand as organizations prioritize privacy and security in their operations.

Digital Transformation Initiatives

The ongoing digital transformation across various sectors in the GCC is a key driver for the data encryption market. As organizations adopt digital technologies, the volume of sensitive data generated increases, necessitating effective encryption solutions. In 2025, the GCC's digital economy is projected to contribute around $100 billion to the region's GDP, highlighting the importance of secure data management. This transformation compels businesses to invest in encryption technologies to protect customer data and comply with regulatory requirements. Thus, the data encryption market is poised for growth as organizations recognize the need for secure data handling in their digital strategies.

Technological Advancements in Encryption

Technological advancements in encryption methods are significantly impacting the data encryption market. Innovations such as quantum encryption and advanced algorithms are enhancing the effectiveness of data protection solutions. In 2025, the encryption technology market is projected to grow at a CAGR of 12%, driven by the demand for more secure and efficient encryption methods. This trend indicates that organizations in the GCC are increasingly adopting cutting-edge encryption technologies to stay ahead of potential threats. As a result, the data encryption market is likely to experience growth as businesses seek to leverage these advancements to enhance their data security posture.