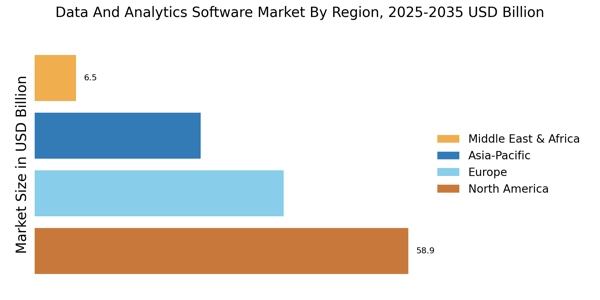

North America : Innovation and Leadership Hub

North America remains the largest market for Data and Analytics Software, holding approximately 45% of the global market share. The region's growth is driven by rapid technological advancements, increasing demand for data-driven decision-making, and supportive regulatory frameworks. The presence of major tech companies and a robust startup ecosystem further catalyze market expansion, with a focus on AI and machine learning integration.

The United States leads the market, followed by Canada, both showcasing a competitive landscape with key players like Microsoft, IBM, and Oracle. These companies are investing heavily in R&D to enhance their offerings. The region's emphasis on data privacy regulations, such as the CCPA, also shapes market dynamics, pushing companies to innovate while ensuring compliance.

Europe : Emerging Data Powerhouse

Europe is witnessing significant growth in the Data and Analytics Software market, accounting for about 30% of the global share. The region's demand is fueled by increasing digital transformation initiatives across various sectors, including finance, healthcare, and retail. Regulatory support, such as GDPR, encourages organizations to adopt data analytics for compliance and operational efficiency, driving market growth.

Leading countries in this region include Germany, the UK, and France, with a competitive landscape featuring key players like SAP and Qlik. The European market is characterized by a strong focus on data security and privacy, influencing software development. Companies are increasingly collaborating with local startups to enhance their analytics capabilities, ensuring they remain competitive in a rapidly evolving market.

Asia-Pacific : Rapidly Growing Market

Asia-Pacific is emerging as a significant player in the Data and Analytics Software market, holding approximately 20% of the global market share. The region's growth is driven by rapid urbanization, increasing internet penetration, and a growing emphasis on data-driven decision-making across industries. Government initiatives promoting digital transformation and smart city projects further catalyze market expansion, making it a key area for investment.

Countries like China, India, and Japan are leading the charge, with a competitive landscape that includes both global giants and local startups. Major players such as IBM and Oracle are expanding their presence, while local firms are innovating to meet regional demands. The focus on AI and machine learning is particularly strong, as businesses seek to leverage data for competitive advantage, creating a dynamic market environment.

Middle East and Africa : Emerging Analytics Frontier

The Middle East and Africa region is gradually becoming a notable player in the Data and Analytics Software market, accounting for about 5% of the global share. The growth is primarily driven by increasing digitalization efforts, government initiatives to promote smart technologies, and a rising awareness of the importance of data analytics in business operations. Countries are investing in infrastructure to support data-driven strategies, which is expected to boost market growth significantly.

Leading countries in this region include South Africa, UAE, and Kenya, where the competitive landscape is evolving with both international and local players. Companies are focusing on tailored solutions to meet specific regional needs, and partnerships are forming to enhance capabilities. The presence of key players like SAP and local startups is fostering innovation, making the region an exciting market for data analytics solutions.