Emergence of IoT and Connected Devices

The proliferation of Internet of Things (IoT) devices is reshaping the Big Data And Business Analytics Market by generating unprecedented volumes of data. As more devices become interconnected, the amount of data produced is expected to reach 175 zettabytes by 2025. This influx of data presents both challenges and opportunities for organizations seeking to harness insights from IoT-generated information. Companies are increasingly adopting analytics solutions that can process and analyze real-time data streams from connected devices, enabling them to optimize operations, enhance customer experiences, and develop innovative products and services. The ability to leverage IoT data effectively is likely to be a key differentiator for businesses aiming to thrive in an increasingly digital and interconnected world.

Rising Demand for Data-Driven Decision Making

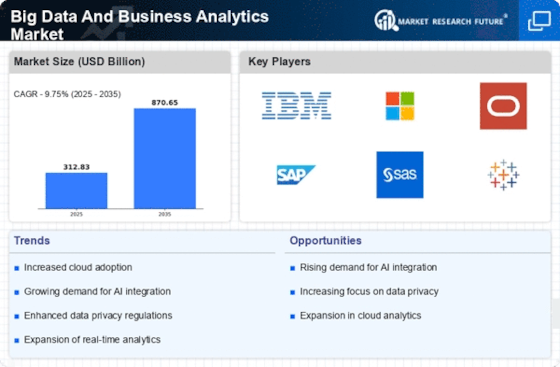

The Big Data And Business Analytics Market is experiencing a notable surge in demand for data-driven decision making. Organizations across various sectors are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. According to recent estimates, the market for business analytics is projected to reach approximately 150 billion USD by 2026, reflecting a compound annual growth rate of around 10%. This trend indicates a shift towards a more analytical approach in business processes, where data insights are utilized to inform decisions, optimize resource allocation, and improve customer engagement. As companies strive to remain competitive, the integration of advanced analytics into their decision-making frameworks appears to be a critical factor in achieving sustainable growth.

Growing Importance of Data Security and Privacy

As the Big Data And Business Analytics Market expands, the importance of data security and privacy has become increasingly paramount. Organizations are now more aware of the potential risks associated with data breaches and the legal implications of non-compliance with data protection regulations. The global expenditure on cybersecurity is projected to exceed 200 billion USD by 2024, highlighting the urgent need for robust security measures. Companies are investing in advanced security solutions to protect sensitive data and ensure compliance with regulations such as GDPR and CCPA. This focus on data security not only safeguards organizational assets but also builds trust with customers, which is essential for fostering long-term relationships and enhancing brand reputation in a data-driven landscape.

Increased Focus on Customer Experience Management

In the current landscape, the Big Data And Business Analytics Market is witnessing a heightened emphasis on customer experience management. Organizations are recognizing that delivering exceptional customer experiences is crucial for retaining clients and driving revenue growth. Data analytics plays a vital role in understanding customer preferences, behaviors, and feedback. By utilizing advanced analytics tools, businesses can gain insights into customer journeys and tailor their offerings accordingly. The market for customer experience management solutions is projected to grow significantly, with estimates suggesting a potential value of over 20 billion USD by 2026. This focus on enhancing customer satisfaction through data-driven strategies is likely to shape the future of business operations, as companies strive to create personalized and engaging experiences for their clientele.

Advancements in Artificial Intelligence and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is significantly influencing the Big Data And Business Analytics Market. These advancements enable organizations to process vast amounts of data more efficiently and derive actionable insights with greater accuracy. The market for AI in analytics is expected to witness substantial growth, with projections indicating a potential increase to over 40 billion USD by 2025. This technological evolution allows businesses to automate data analysis, enhance predictive modeling, and improve customer personalization. Consequently, organizations that adopt AI and ML capabilities are likely to gain a competitive edge, as they can respond more swiftly to market changes and customer needs, thereby driving innovation and operational excellence.