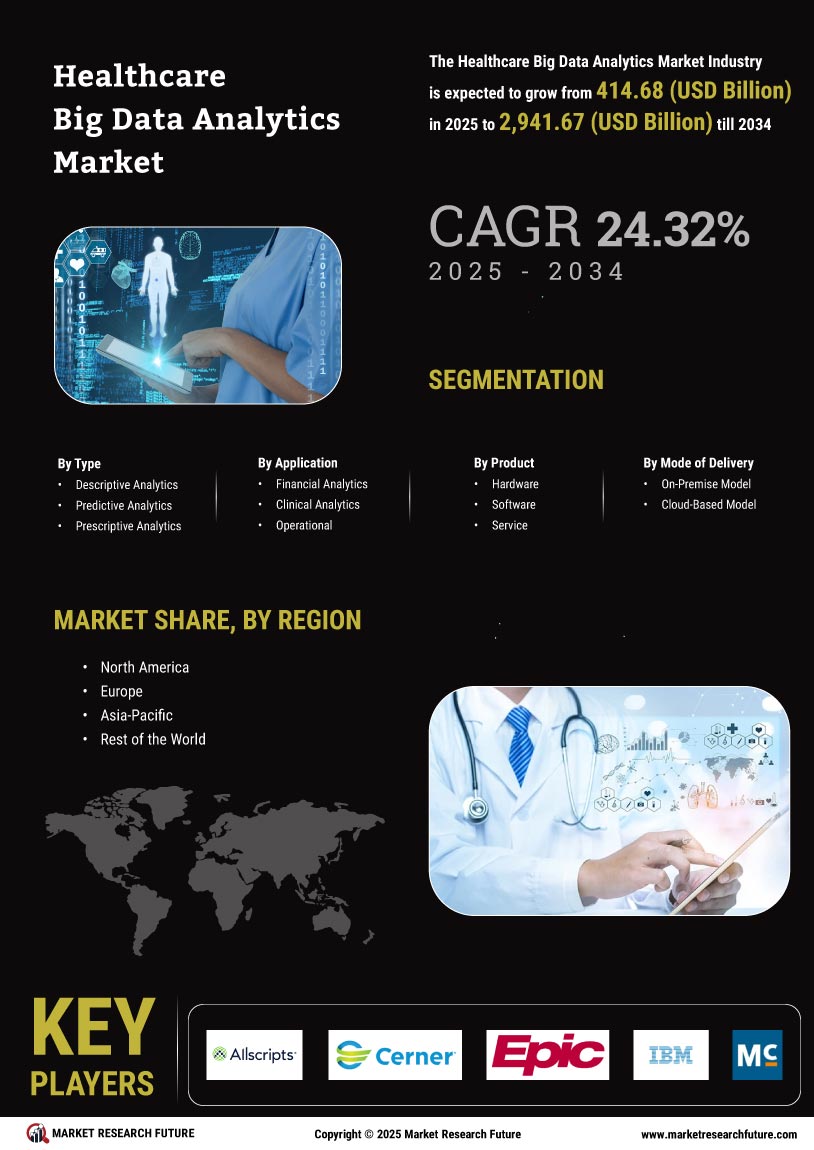

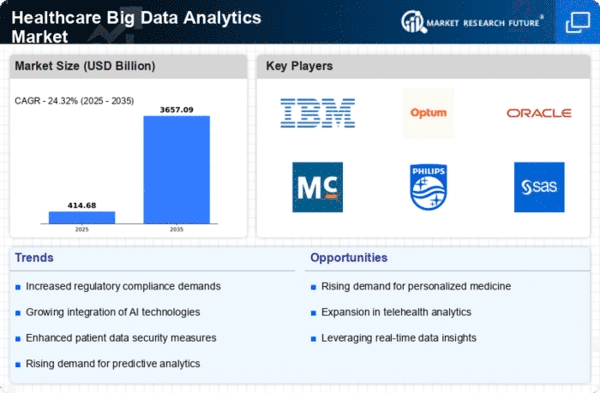

Market Growth Projections

The Global Healthcare Big Data Analytics Market Industry is projected to experience robust growth in the coming years. With an estimated market value of 333.6 USD Billion in 2024, the industry is poised for significant expansion. Analysts forecast a compound annual growth rate (CAGR) of 24.32% from 2025 to 2035, indicating a strong upward trend. This growth is driven by various factors, including technological advancements, increasing healthcare data volumes, and a growing emphasis on data-driven decision-making. As healthcare organizations continue to adopt analytics solutions, the market is likely to evolve, presenting new opportunities for stakeholders.

Regulatory Support and Initiatives

Regulatory support and initiatives are crucial drivers of the Global Healthcare Big Data Analytics Market Industry. Governments worldwide are increasingly recognizing the importance of data analytics in improving healthcare systems. Initiatives aimed at promoting the adoption of electronic health records and data sharing are being implemented to enhance patient care. For instance, the U.S. government has introduced policies to encourage the use of health information technology, which in turn fosters the growth of analytics solutions. This supportive regulatory environment is likely to facilitate market expansion, as healthcare entities seek to comply with regulations while improving operational efficiencies.

Increasing Volume of Healthcare Data

The increasing volume of healthcare data is a primary driver of the Global Healthcare Big Data Analytics Market Industry. With the proliferation of electronic health records, wearable devices, and mobile health applications, healthcare organizations are inundated with vast amounts of data. This data, if effectively analyzed, can yield valuable insights into patient care and operational efficiencies. As organizations seek to harness this data for better decision-making, the demand for advanced analytics solutions is likely to surge. The market's growth trajectory suggests that by 2035, it could reach 3657.1 USD Billion, reflecting the critical role of data analytics in modern healthcare.

Growing Focus on Preventive Healthcare

The Global Healthcare Big Data Analytics Market Industry is significantly influenced by the growing focus on preventive healthcare. As healthcare systems shift from reactive to proactive approaches, analytics tools are increasingly utilized to identify health trends and risk factors. For instance, population health management programs leverage data analytics to monitor chronic diseases and implement preventive measures. This shift not only improves patient outcomes but also reduces healthcare costs. The market is expected to grow at a CAGR of 24.32% from 2025 to 2035, as healthcare providers invest in analytics to enhance preventive care strategies.

Technological Advancements in Data Analytics

Technological advancements play a pivotal role in shaping the Global Healthcare Big Data Analytics Market Industry. Innovations in artificial intelligence, machine learning, and cloud computing are enabling healthcare organizations to process and analyze large volumes of data more efficiently. For example, predictive analytics tools are being employed to identify at-risk patients, allowing for timely interventions. These advancements not only enhance the accuracy of analyses but also reduce operational costs. As these technologies continue to evolve, the market is anticipated to experience substantial growth, potentially reaching 3657.1 USD Billion by 2035, driven by the demand for sophisticated analytics solutions.

Rising Demand for Data-Driven Decision Making

The Global Healthcare Big Data Analytics Market Industry is witnessing an increasing demand for data-driven decision making among healthcare providers. This trend is largely fueled by the need to enhance patient outcomes and streamline operations. For instance, hospitals are increasingly utilizing analytics to predict patient admissions and optimize resource allocation. The market is projected to reach 333.6 USD Billion in 2024, reflecting a growing recognition of the value of data in improving healthcare delivery. As healthcare organizations strive to leverage insights from vast datasets, the reliance on analytics tools is expected to escalate, further propelling market growth.