Construction 4.0 Market Summary

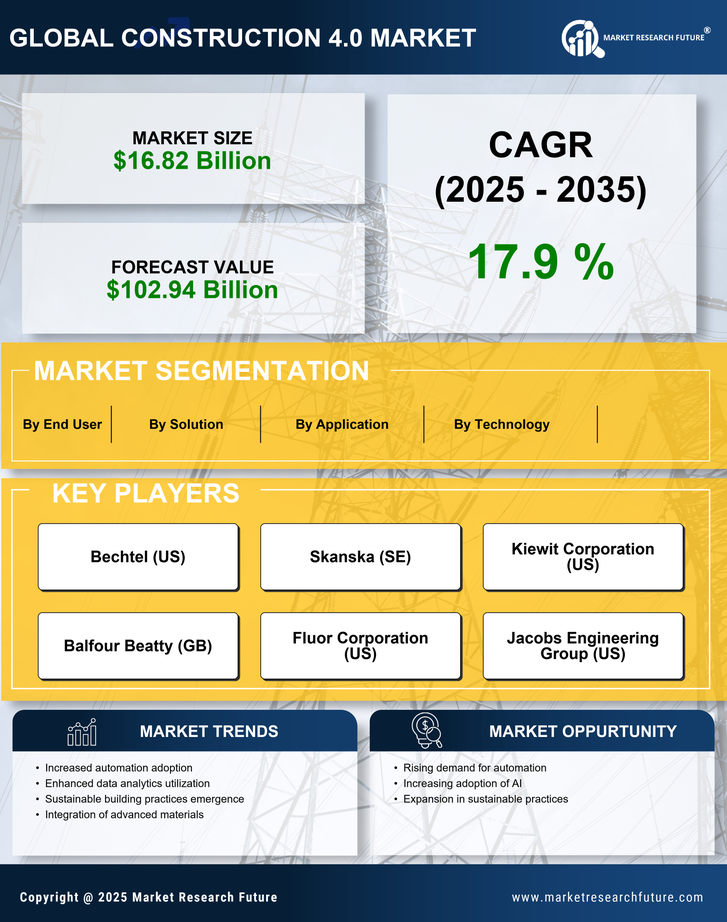

As per Market Research Future analysis, the Construction 4.0 Market Size was estimated at 16.82 USD Billion in 2024. The Construction 4.0 industry is projected to grow from 19.84 USD Billion in 2025 to 102.94 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 17.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Construction 4.0 Market is poised for transformative growth driven by advanced technologies and sustainability initiatives.

- The integration of advanced technologies is reshaping construction processes, enhancing efficiency and productivity.

- Sustainability remains a focal point, with an increasing emphasis on green building practices across projects.

- Enhanced collaboration and communication tools are becoming essential for successful project delivery in the industry.

- Key market drivers include the integration of IoT and AI technologies, alongside increased investment in construction technology.

Market Size & Forecast

| 2024 Market Size | 16.82 (USD Billion) |

| 2035 Market Size | 102.94 (USD Billion) |

| CAGR (2025 - 2035) | 17.9% |

Major Players

Bechtel (US), Skanska (SE), Kiewit Corporation (US), Balfour Beatty (GB), Fluor Corporation (US), Jacobs Engineering Group (US), Turner Construction Company (US), Lendlease (AU), VINCI (FR)