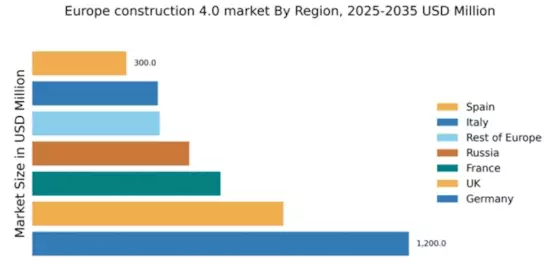

Germany : Strong Growth Driven by Innovation

Germany holds a commanding market share of 30% in the European construction sector, valued at $1,200.0 million. Key growth drivers include robust government investments in infrastructure, particularly in renewable energy and transportation. Demand for sustainable construction practices is rising, supported by regulatory policies aimed at reducing carbon emissions. The government’s commitment to enhancing public infrastructure is evident in initiatives like the Federal Transport Infrastructure Plan, which allocates significant funding for modernization projects.

UK : Navigating Economic Uncertainties

The UK construction market represents 20% of the European sector, valued at $800.0 million. Growth is driven by a strong housing demand and infrastructure projects, particularly in urban areas. The government’s 'Build Back Better' initiative aims to stimulate recovery post-pandemic, focusing on green building practices. However, challenges such as labor shortages and material costs are impacting growth, necessitating adaptive strategies in project management and procurement.

France : Focus on Green Building Initiatives

France captures 15% of the European construction market, valued at $600.0 million. The growth is propelled by government policies promoting sustainable construction and energy efficiency. The 'France Relance' plan emphasizes investments in green infrastructure, driving demand for eco-friendly materials and technologies. Urbanization trends in cities like Paris and Lyon are also contributing to increased construction activities, particularly in residential and commercial sectors.

Russia : Revitalizing Infrastructure Projects

Russia holds a 12.5% share of the European construction market, valued at $500.0 million. Key growth drivers include government-led infrastructure projects aimed at modernizing transport and utilities. The 'National Project for Housing and Urban Environment' is a significant initiative, enhancing residential construction. However, geopolitical tensions and economic sanctions pose challenges, affecting foreign investments and market stability.

Italy : Focus on Infrastructure and Housing

Italy accounts for 10% of the European construction market, valued at $400.0 million. Growth is driven by a resurgence in public infrastructure projects and housing demand, particularly in regions like Lombardy and Lazio. The government’s 'Piano Nazionale di Ripresa e Resilienza' aims to boost construction through investments in sustainable infrastructure. However, bureaucratic hurdles and economic fluctuations remain challenges for market players.

Spain : Urban Development and Renovation Focus

Spain represents 7.5% of the European construction market, valued at $300.0 million. The market is experiencing growth due to urban development projects and a focus on renovating existing structures. Government initiatives like the 'Plan de Recuperación' are aimed at revitalizing the construction sector post-COVID-19. Key cities such as Madrid and Barcelona are central to this growth, although challenges like labor shortages persist.

Rest of Europe : Varied Growth Dynamics in Construction

The Rest of Europe accounts for 10.15% of the construction market, valued at $406.0 million. This sub-region includes diverse markets with varying growth dynamics, driven by local government initiatives and infrastructure needs. Countries like Austria and the Netherlands are focusing on sustainable construction practices, while Eastern European nations are investing in modernization. The competitive landscape features both local and international players, adapting to regional demands and regulations.