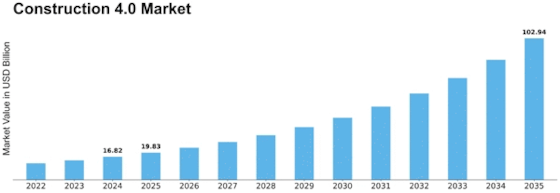

Construction 4 0 Size

Construction 4.0 Market Growth Projections and Opportunities

The size of the Construction 4.0 Market reached in 2022 was approximately USD 12.1 Billion. Based on the estimation, the construction 4.0 industry is expected to grow from USD 14.27 Billion in 2023 to USD 53.26 Billion by 2032 with a CAGR of 17.90% (Compound Annual Growth Rate).

At present moment, the Construction 4.0 market undergoes enormous changes driven mostly by different market factors, which determine its dynamics. Among the main factors, which includes technological progress. The engineering of novel techniques including BIM, IoT, and AI has brought a renaissance to the construction sector. The application of these technologies result in several improvements such as speeding up the project, reducing mistakes, and providing a platform for communication among all the stakeholders of the Construction 4.0 industry.

Sustainability is another important factor which impacts the market. As a result of increasing environmental activism and efficiency, constructions 4.0 are converting to eco-friendly methods. Sustainable construction has emerged as a trend, incorporating the use of sustainable materials, energy-efficient designs, and green construction techniques. This showing that there are and moreover, consumers are opting to use environmentally friendly constructions.

Along with global economic issues, the Construction 4.0 market also greatly suffers the impact of these global economic conditions. Economic stability, government policies and financial investments will significantly impact the volume of construction work that can be accomplished. With regard to the economy's upswing, there appears to be increased infrastructure development and construction projects thus Construction 4.0 market expands. However, economic depressions may cause project delays, investment level decrease and the market growth slowdown.

The government is a critical player in the elements of the market that affect construction 4.0 through laws and policies. Governments all over the globe are paying attention very much to safety norms, energy efficiency, and quality care in construction projects. Adherence to the regulations set up in this case not only assures project integrity but also generates confidence among stakeholders. The integration of all Construction 4.0 methods in terms of laws and regulations is key to continuous market growth.

Moreover, population trends and urbanization further determine the dimension of development of Construction 4.0 market. With an expansion of population and a trend of moving to urban areas this increases the infrastructure requirements as well as those solutions requiring smartness. Technologies of construction 4.0 have the potential to introduce new innovations that help solving the problems of urbanization, like fast transportation systems, intelligent buildings and integrated infrastructure. For businesses working in the Construction 4.0 market, the ability to understand demographical shifts and make necessary adjustments is paramount.

Leave a Comment