Increasing Demand for Air Travel

The Commercial aircraft aerostructure Market is experiencing a notable surge in demand for air travel, driven by rising disposable incomes and a growing middle class in various regions. This trend is expected to lead to an increase in aircraft production, thereby boosting the demand for aerostructures. According to industry forecasts, the number of commercial aircraft deliveries is projected to reach approximately 39,000 units over the next two decades. This escalating demand necessitates the development of advanced aerostructures that are not only lightweight but also capable of enhancing fuel efficiency, thereby aligning with the industry's focus on sustainability. As airlines expand their fleets to accommodate more passengers, the Commercial Aircraft Aerostructure Market is poised for significant growth.

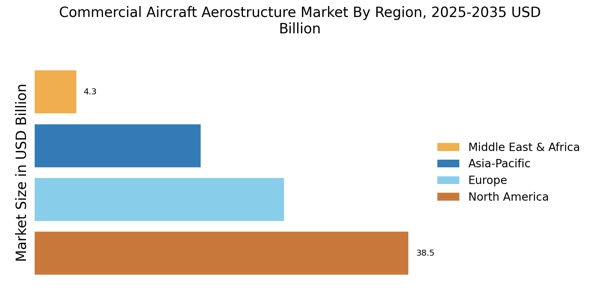

Emerging Markets and Regional Growth

Emerging markets are becoming increasingly influential in the Commercial Aircraft Aerostructure Market, as countries in Asia-Pacific, the Middle East, and Latin America expand their aviation sectors. These regions are witnessing a rise in air travel demand, leading to increased investments in aircraft manufacturing and aerostructure production. Governments are also supporting the growth of the aviation industry through favorable policies and infrastructure development. As a result, manufacturers are looking to establish production facilities in these regions to capitalize on the burgeoning market opportunities. This regional growth is expected to create a ripple effect, stimulating further advancements in aerostructure technologies and contributing to the overall expansion of the Commercial Aircraft Aerostructure Market.

Regulatory Compliance and Safety Standards

The Commercial Aircraft Aerostructure Market is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. These regulations are designed to ensure the safety and reliability of aircraft, which in turn drives the demand for high-quality aerostructures. Manufacturers are compelled to invest in research and development to meet these evolving standards, leading to innovations in design and materials. The emphasis on safety not only enhances consumer confidence but also encourages airlines to upgrade their fleets with newer, safer aircraft. As a result, the demand for advanced aerostructures that comply with these regulations is expected to rise, further propelling the growth of the Commercial Aircraft Aerostructure Market.

Focus on Fuel Efficiency and Sustainability

The Commercial Aircraft Aerostructure Market is increasingly prioritizing fuel efficiency and sustainability in response to environmental concerns and rising fuel costs. Airlines are under pressure to reduce their carbon footprints, prompting manufacturers to develop aerostructures that enhance fuel efficiency. Innovations such as lightweight materials and aerodynamic designs are being adopted to achieve these goals. The market is witnessing a shift towards sustainable practices, with many companies investing in research to create eco-friendly materials and production processes. This focus on sustainability not only meets regulatory requirements but also appeals to environmentally conscious consumers. As the industry moves towards greener solutions, the demand for advanced aerostructures is expected to grow, driving the Commercial Aircraft Aerostructure Market forward.

Technological Advancements in Aerostructures

Technological innovations are playing a pivotal role in shaping the Commercial Aircraft Aerostructure Market. The integration of advanced materials, such as carbon fiber reinforced polymers, is revolutionizing the design and manufacturing processes of aerostructures. These materials offer superior strength-to-weight ratios, which are essential for improving aircraft performance and fuel efficiency. Furthermore, advancements in manufacturing techniques, such as additive manufacturing and automated assembly processes, are streamlining production and reducing costs. The market is witnessing a shift towards more complex and efficient aerostructures, which are expected to enhance the overall performance of commercial aircraft. As these technologies continue to evolve, they are likely to drive the Commercial Aircraft Aerostructure Market towards new heights.