Increasing Air Travel Demand

The Global Commercial Aircraft Landing Gear Industry is experiencing growth driven by the rising demand for air travel. As more passengers opt for air transportation, airlines are expanding their fleets to accommodate this surge. The International Air Transport Association projects that global air passenger numbers will reach 8.2 billion by 2037, necessitating more aircraft and, consequently, more landing gear systems. This expansion is expected to contribute to the market's valuation, projected to reach 7.11 USD Billion in 2024 and potentially 22.4 USD Billion by 2035, reflecting a compound annual growth rate of 11.01% from 2025 to 2035.

Market Trends and Growth Projections

The Global Commercial Aircraft Landing Gear Industry is poised for substantial growth, with projections indicating a market size of 7.11 USD Billion in 2024 and an anticipated increase to 22.4 USD Billion by 2035. The compound annual growth rate is expected to be 11.01% from 2025 to 2035. This growth trajectory reflects the convergence of various factors, including rising air travel demand, technological advancements, and regulatory pressures. The market dynamics suggest a robust future for landing gear systems, driven by both established and emerging players in the aviation sector.

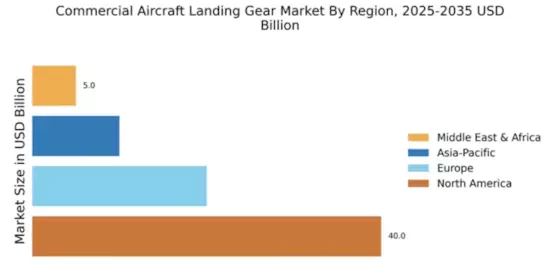

Emerging Markets and Regional Expansion

The Global Commercial Aircraft Landing Gear Industry is witnessing growth fueled by the expansion of emerging markets. Countries in Asia-Pacific and the Middle East are investing heavily in their aviation infrastructure, leading to an increase in aircraft orders. For example, the Asia-Pacific region is projected to account for a substantial share of new aircraft deliveries over the next decade. This regional expansion is likely to stimulate demand for landing gear systems, as airlines in these markets seek to modernize their fleets. The growing middle-class population in these regions further supports the demand for air travel, thereby enhancing market prospects.

Regulatory Compliance and Safety Standards

The Global Commercial Aircraft Landing Gear Industry is significantly influenced by stringent regulatory compliance and safety standards imposed by aviation authorities. Organizations such as the Federal Aviation Administration and the European Union Aviation Safety Agency enforce rigorous safety protocols that landing gear systems must meet. Compliance with these regulations often necessitates upgrades and innovations in landing gear technology, thereby driving demand. As safety remains a paramount concern in aviation, manufacturers are compelled to invest in research and development to ensure their products meet evolving standards, which in turn supports market expansion.

Focus on Fuel Efficiency and Sustainability

The Global Commercial Aircraft Landing Gear Industry is increasingly aligned with the aviation sector's focus on fuel efficiency and sustainability. Airlines are under pressure to reduce carbon emissions and operational costs, prompting a shift towards more efficient aircraft designs. Landing gear systems play a crucial role in this transition, as advancements in design and materials can lead to significant weight reductions and improved aerodynamics. Consequently, manufacturers are innovating to produce landing gear that not only meets performance standards but also aligns with sustainability goals, thus driving market growth in the coming years.

Technological Advancements in Landing Gear Systems

Technological innovations are pivotal in shaping the Global Commercial Aircraft Landing Gear Industry. The integration of advanced materials and smart technologies enhances the performance and reliability of landing gear systems. For instance, the use of lightweight composite materials reduces overall aircraft weight, improving fuel efficiency and operational costs. Furthermore, the implementation of predictive maintenance technologies allows for timely interventions, reducing downtime and enhancing safety. As airlines increasingly prioritize efficiency and safety, the demand for technologically advanced landing gear systems is likely to rise, further propelling market growth.