Air Cargo and Freight Expansion

Air freight demand is growing at 3.3% annually, with the freighter fleet expanding 45% to 3,420 aircraft by 2044, requiring 2,605 additional units (935 new-builds, 1,670 conversions). E-commerce growth (global sales to USD 8.1 trillion by 2028) and disruptions in ocean shipping (e.g., due to tariffs and geopolitical issues) have increased air cargo traffic by 2-4.3% in early 2025, with yields 30-35% above 2019 levels. This drives aerostructure needs for efficient cargo aircraft.

Sustainability and Fuel Efficiency Imperatives

Rising fuel costs and environmental pressures are pushing for fuel-efficient aircraft, with new models offering up to 25% better efficiency and reduced CO2 emissions per RPK. Investments in sustainable aviation fuels (SAF), with aircraft becoming 100% SAF-capable by 2030, and R&D in aerodynamics and propulsion (e.g., Airbus's €2.7 billion in 2024) drive aerostructure innovations. Global efforts to decarbonize aviation, including hybrid-electric propulsion, align with broader sustainability goals, boosting demand for eco-friendly materials like thermoplastics.

Supply Chain Recovery and Geopolitical Influences

Post-pandemic supply chain stabilization, with 85% executive confidence in on-time deliveries (up from 77%), is supported by diversification (e.g., sourcing from India) and long-term agreements. However, constraints like engine shortages and quality issues (e.g., Boeing's 737 inventory holds) extend older aircraft lifespans, indirectly boosting aerostructure demand. Geopolitical tensions, including US-China tariffs, reposition routes and increase cargo reliance on air transport.

Increasing Defense and Military Modernization Spending

Global defense budgets exceeded USD 2.2 trillion in 2024, with a focus on military aircraft, unmanned platforms, and hypersonics amid geopolitical tensions (e.g., NATO allies' investments). Defense spending is projected to rise 5.1% annually through 2025, driving demand for aerostructures in jet fighters, helicopters, and UAVs. In regions like India, increased defense capital expenditure supports fleet upgrades and new acquisitions. The UAV market alone is expected to grow from USD 36 billion in 2024 to USD 41 billion in 2025, with a 16% CAGR through 2037, spurred by applications in defense (e.g., Russia-Ukraine conflict) and emerging sectors like agriculture.

Adoption of Advanced Materials and Technological Innovations

The shift toward lightweight composites, alloys, and additive manufacturing (3D printing) is a major driver, as these materials reduce aircraft weight by up to 20-30%, improving fuel efficiency and meeting environmental regulations. Composites are projected to comprise over 50% of aircraft materials by 2030, as seen in models like the Boeing 787 and Airbus A350. Technological advancements, including AI, IoT, robotics, blockchain, and biomimicry (e.g., winglets for better aerodynamics), enable novel designs that lower operating costs and extend flight ranges. Additive manufacturing in aerospace is forecasted to reach USD 8.5 billion by 2026 at a 20.4% CAGR, allowing for complex, customized components. Digital tools like predictive maintenance and digital twins (e.g., used by Embraer and Rolls-Royce) further enhance production efficiency amid labor shortages.

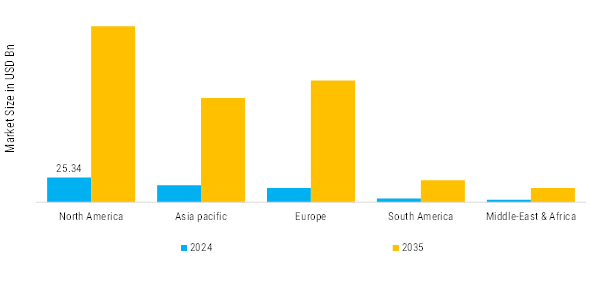

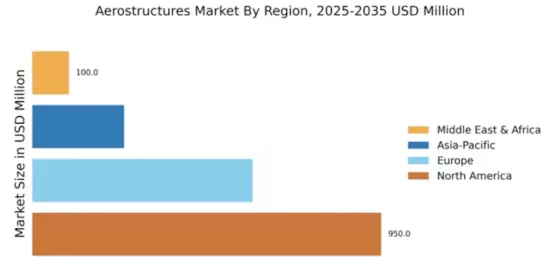

Surging Demand for Commercial Air Travel and Fleet Expansion

Global passenger traffic, measured in Revenue Passenger Kilometres (RPKs), is expected to grow at 3.6% annually through 2044, driven by economic recovery, an expanding middle class (adding 1.5 billion people globally), and urbanization (adding 1.3 billion urban dwellers). This translates to a near-doubling of the global aircraft fleet from 24,730 in 2025 to 49,210 by 2044, requiring 43,420 new deliveries, including 34,250 single-aisle and 9,170 widebody aircraft. In 2025 alone, aircraft deliveries are projected to rise 23%, with OEMs like Boeing and Airbus ramping up production (e.g., Boeing's 737 MAX to 38 units per month, Airbus's A320 to 75 by 2027). Emerging markets, particularly in Asia-Pacific (e.g., India and China), are key contributors, with domestic India traffic growing at 8.9% annually and Asia-Pacific passenger numbers expected to double by 2037. Rising personal incomes and population growth in developing economies further amplify demand for civil, regional, and business jets.