Growth in Air Travel

The aircraft aerostructure Market is experiencing robust growth due to the rising number of air travelers. With an increasing middle-class population and expanding economies, air travel demand is expected to rise substantially. Recent statistics indicate that passenger traffic is anticipated to double in the next 20 years, necessitating the production of new aircraft. This surge in demand for new aircraft directly influences the Aircraft Aerostructure Market, as manufacturers must ramp up production of aerostructures to meet the needs of airlines. This trend suggests a promising outlook for the industry as it adapts to the evolving landscape of air travel.

Increasing Demand for Fuel Efficiency

The Aircraft Aerostructure Market is witnessing a pronounced shift towards fuel-efficient aircraft designs. Airlines and manufacturers are increasingly prioritizing aerostructures that minimize weight while maximizing structural integrity. This trend is driven by rising fuel costs and stringent environmental regulations. According to recent data, the demand for fuel-efficient aircraft is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade. Consequently, manufacturers are investing in advanced materials and innovative designs to enhance fuel efficiency, which is likely to bolster the Aircraft Aerostructure Market significantly.

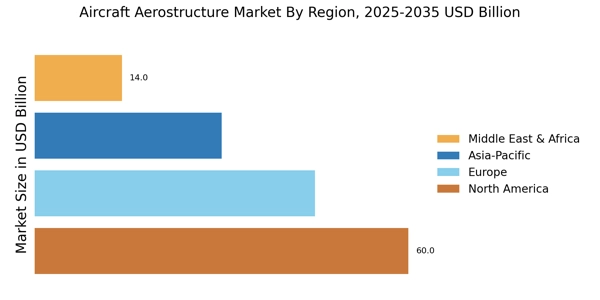

Emerging Markets and Regional Expansion

The Aircraft Aerostructure Market is poised for expansion in emerging markets, where economic growth is driving increased investment in aviation infrastructure. Countries in Asia and the Middle East are witnessing a surge in air travel, prompting local airlines to expand their fleets. This trend creates a substantial opportunity for manufacturers in the Aircraft Aerostructure Market to establish partnerships and supply chains in these regions. As these markets develop, the demand for advanced aerostructures is expected to rise, potentially leading to a significant increase in production and innovation within the industry.

Regulatory Compliance and Safety Standards

The Aircraft Aerostructure Market is significantly influenced by stringent regulatory compliance and safety standards. Governments and aviation authorities are continuously updating regulations to ensure the safety and reliability of aircraft. This necessitates that manufacturers invest in high-quality aerostructures that meet these evolving standards. As a result, the demand for advanced materials and innovative designs is likely to increase, driving growth in the Aircraft Aerostructure Market. Compliance with these regulations not only enhances safety but also boosts consumer confidence, which is essential for the industry's long-term sustainability.

Technological Innovations in Manufacturing

Technological advancements are reshaping the Aircraft Aerostructure Market, particularly in manufacturing processes. Innovations such as additive manufacturing and automation are enhancing production efficiency and reducing costs. For instance, the adoption of 3D printing technology allows for the creation of complex aerostructures with reduced material waste. This shift towards advanced manufacturing techniques is expected to drive growth in the Aircraft Aerostructure Market, as companies seek to improve their competitive edge. Furthermore, the integration of digital technologies in manufacturing processes is likely to streamline operations and enhance product quality, further propelling the industry forward.