North America : Market Leader in Chips

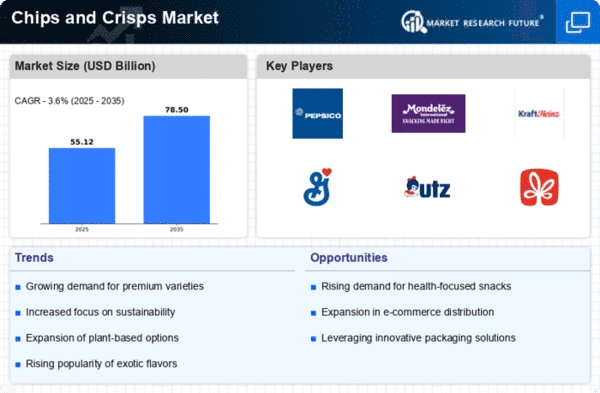

North America continues to lead the chips and crisps market, holding a significant share of 26.0% in 2024. The growth is driven by increasing consumer demand for convenient snacking options, innovative flavors, and healthier alternatives. Regulatory support for food safety and labeling has also bolstered market confidence, encouraging new product launches and expansions. The region's robust distribution networks further enhance accessibility, catering to diverse consumer preferences. The competitive landscape is characterized by major players such as PepsiCo, Mondelez International, and Kraft Heinz, which dominate the market with their extensive product portfolios. The U.S. remains the largest market, driven by a culture of snacking and high disposable income. Companies are increasingly focusing on sustainability and health-conscious products to meet evolving consumer demands, ensuring their continued leadership in the market.

Europe : Emerging Trends in Europe

Europe's chips and crisps market is valued at €15.0 billion, reflecting a growing trend towards health-conscious snacking. Factors such as rising awareness of nutrition and the demand for organic and gluten-free options are driving this growth. Regulatory frameworks in the EU promote transparency in food labeling, which encourages consumers to make informed choices. This shift towards healthier snacks is expected to continue influencing market dynamics in the coming years. Leading countries in this region include Germany, the UK, and France, where established brands like Intersnack Group and Pringles are prominent. The competitive landscape is evolving, with new entrants focusing on niche markets and innovative flavors. The presence of key players ensures a diverse product offering, catering to various consumer preferences and dietary needs. The market is poised for further growth as companies adapt to changing consumer behaviors and preferences.

Asia-Pacific : Rapid Growth in Asia-Pacific

The Asia-Pacific region, with a market size of $10.0 billion, is witnessing rapid growth in the chips and crisps sector. Factors such as urbanization, changing lifestyles, and increasing disposable incomes are driving demand for convenient snack options. Additionally, the influence of Western eating habits is leading to a surge in popularity for chips and crisps. Regulatory initiatives aimed at improving food safety standards are also contributing to market growth, ensuring consumer trust in products available in the market. Countries like Japan, China, and India are at the forefront of this growth, with local and international brands competing for market share. Key players such as Calbee and Lays are expanding their product lines to include unique flavors that cater to regional tastes. The competitive landscape is dynamic, with a mix of established brands and emerging players, making the Asia-Pacific market a vibrant arena for innovation and growth.

Middle East and Africa : Developing Market Potential

The Middle East and Africa (MEA) region, with a market size of $2.2 billion, presents significant growth opportunities in the chips and crisps market. Factors such as increasing urbanization, a young population, and rising disposable incomes are driving demand for snack foods. Additionally, the region's diverse culinary traditions are influencing flavor preferences, leading to a growing variety of products. Regulatory frameworks are gradually improving, which is expected to enhance market conditions and consumer confidence in food safety. Countries like South Africa and the UAE are leading the market, with local brands gaining traction alongside international players. The competitive landscape is characterized by a mix of established companies and new entrants, focusing on innovative flavors and healthier options. As the market continues to evolve, companies are likely to invest in product development and marketing strategies to capture the growing consumer base.