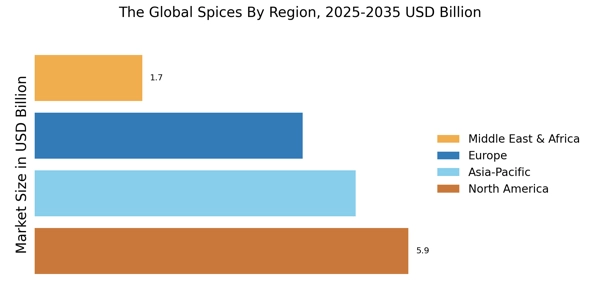

North America : Market Leader in Spices Market

North America is the largest market for spices, accounting for approximately 35% of the global share. The region's growth is driven by increasing consumer demand for diverse flavors and health-conscious products. Regulatory support for food safety and quality standards further catalyzes market expansion. The rise of e-commerce and specialty food stores also contributes to the growing accessibility of spices, enhancing consumer engagement and sales. The United States is the leading country in this region, with significant contributions from Canada and Mexico. Key players like McCormick & Company and Kraft Heinz Company dominate the market, leveraging strong distribution networks and innovative product offerings. The competitive landscape is characterized by a mix of established brands and emerging players, all vying for market share in a rapidly evolving consumer environment.

Europe : Emerging Market Dynamics

Europe is witnessing a significant transformation in the spices market, holding approximately 25% of the global share. The demand for organic and natural spices is on the rise, driven by health trends and consumer preferences for clean-label products. Regulatory frameworks, such as the EU's food safety regulations, play a crucial role in ensuring quality and safety, thus fostering consumer trust and market growth. Leading countries in this region include Germany, France, and the UK, with Germany being the largest market. The competitive landscape features major players like Associated British Foods and Döhler Group, who are focusing on product innovation and sustainability. The presence of local and international brands creates a dynamic market environment, encouraging competition and enhancing product diversity.

Asia-Pacific : Rapid Growth and Innovation

Asia-Pacific is emerging as a powerhouse in The Global Spices Market, accounting for around 30% of the total market share. The region's growth is fueled by increasing culinary diversity, rising disposable incomes, and a growing interest in ethnic cuisines. Five Spice Asian Market. The Five Spice Asian market sector is expanding as Western home cooks increasingly seek out authentic star anise and Szechuan peppercorn blends to replicate traditional Eastern flavors.

India, China, and Japan are the leading countries in this region, with India being the largest producer and exporter of spices globally. Growth in the Indian spice food market is being driven by the rapid premiumization of blended masalas, which offer convenience without compromising on regional authenticity. The India spice market continues to functions as the primary engine of global supply, producing nearly three-quarters of the world’s spices across its diverse agricultural zones. The region's unique flavors and traditional practices are driving innovation, making it a key area for market development and investment.

Middle East and Africa : Diverse Market Opportunities

The Middle East and Africa region is witnessing a gradual increase in the spices market, holding approximately 10% of the global share. The Spice Market Dubai remains a sensory landmark where traditional dhows continue to unload sacks of aromatic frankincense, dried limes, and rare saffron from across the Middle East. The growth is driven by the rising popularity of spices in traditional cuisines and the increasing demand for processed food products. The historic Istanbul Spice Market, also known as the Egyptian Bazaar, remains a vital cultural bridge where ancient silk road traditions meet the modern demand for premium Middle Eastern saffron and dried herbs

Regulatory frameworks are evolving to support food safety and quality, which is essential for market growth in this diverse region. Leading countries include South Africa, Egypt, and the UAE, where local and international brands are competing for market share. Key players like Aust & Hachmann are focusing on expanding their product lines to cater to the growing consumer base. The competitive landscape is characterized by a mix of traditional spice markets and modern retail channels, creating unique opportunities for growth and innovation.