Integration of AI and Automation

The integration of artificial intelligence (AI) and automation technologies into the drone camera market in China is transforming operational capabilities. AI-powered drones are capable of advanced image processing, enabling features such as object recognition and automated flight paths. This technological evolution is expected to enhance the efficiency and effectiveness of drone operations across various industries. For instance, in agriculture, AI-enabled drones can analyze crop health and optimize resource allocation, potentially increasing yields by up to 30%. The market for AI-integrated drone cameras is projected to grow at a compound annual growth rate (CAGR) of 25% over the next five years. This integration not only improves functionality but also attracts a broader range of users, from hobbyists to professionals, thereby driving growth in the drone camera market.

Government Support and Investment

Government support and investment in drone technology are pivotal drivers for the drone camera market in China. The Chinese government has implemented various initiatives to promote the development and adoption of drone technology, including funding for research and development and the establishment of drone testing zones. In 2025, government investment in drone technology is expected to exceed $500 million, aimed at fostering innovation and enhancing regulatory frameworks. This support not only encourages domestic manufacturers but also attracts foreign investment, further stimulating market growth. Additionally, the government's focus on integrating drones into public services, such as disaster management and surveillance, underscores the strategic importance of the drone camera market. As a result, government support and investment are likely to play a crucial role in shaping the future landscape of the drone camera market in China.

Expansion of Commercial Applications

The drone camera market in China is witnessing an expansion of commercial applications, which is significantly contributing to its growth. Industries such as construction, logistics, and environmental monitoring are increasingly adopting drone technology for various purposes. For example, construction companies utilize drone cameras for site surveys and progress monitoring, which can reduce project timelines by up to 15%. The logistics sector is also exploring drone deliveries, with the market for drone delivery services projected to reach $2 billion by 2026. This diversification of applications not only enhances the utility of drone cameras but also attracts investment and innovation within the sector. As businesses recognize the potential cost savings and efficiency improvements, the expansion of commercial applications is likely to remain a key driver for the drone camera market in China.

Growing Interest in Recreational Use

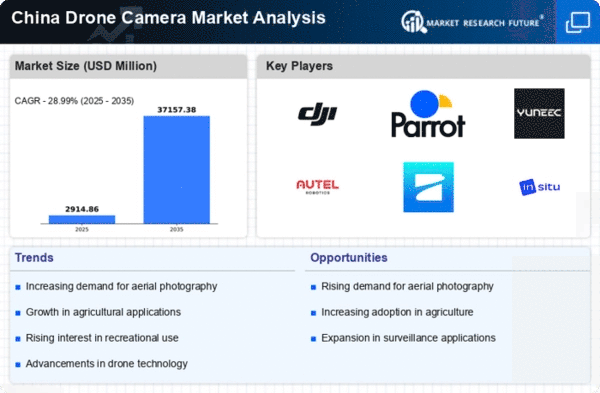

The growing interest in recreational use of drone cameras is emerging as a significant driver for the drone camera market in China. As more individuals engage in hobbies such as aerial photography and videography, the demand for consumer-grade drone cameras is on the rise. In 2025, the market for recreational drone cameras is projected to reach approximately $1 billion, reflecting a CAGR of around 18%. This trend is fueled by the increasing accessibility of drone technology, with manufacturers offering a range of affordable options for hobbyists. Furthermore, social media platforms are amplifying the appeal of drone photography, as users seek to share unique perspectives and experiences. Consequently, the growing interest in recreational use is likely to continue driving the drone camera market in China, fostering a vibrant community of enthusiasts.

Rising Demand for Aerial Photography

The demand for aerial photography in China's drone camera market is experiencing a notable surge, driven by various sectors including real estate, agriculture, and tourism. As property developers and agricultural businesses increasingly recognize the value of high-quality aerial imagery, the market is projected to grow significantly. In 2025, the market for drone cameras in the real estate sector alone is estimated to reach approximately $1.5 billion, reflecting a growth rate of around 20% annually. This trend indicates a shift towards more innovative marketing strategies, where aerial photography plays a crucial role in showcasing properties and landscapes. Furthermore, the tourism industry is leveraging drone technology to enhance promotional content, thereby expanding the customer base and increasing engagement. Consequently, the rising demand for aerial photography is a pivotal driver for the drone camera market in China.