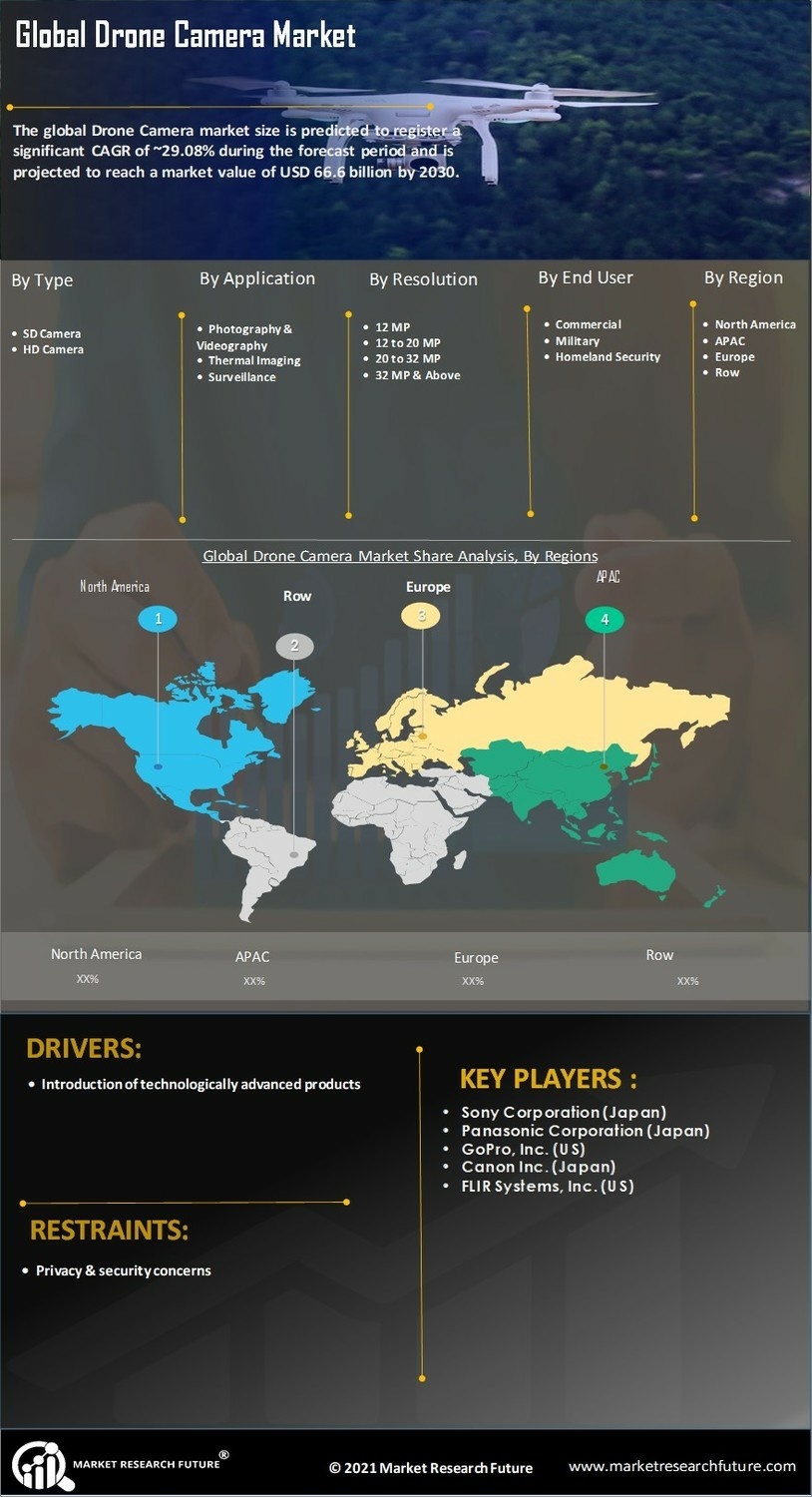

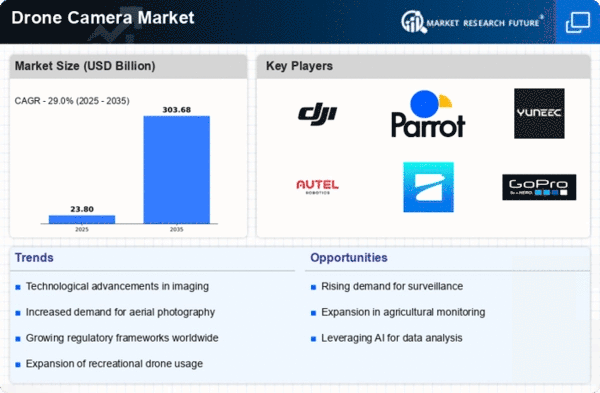

Market Growth Projections

The Global Drone Camera Market Industry is projected to experience substantial growth, with estimates indicating a market value of 18.3 USD Billion in 2024 and a remarkable increase to 236.5 USD Billion by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 26.19% from 2025 to 2035. Such projections highlight the increasing integration of drone cameras across various sectors and the growing consumer demand for aerial imaging solutions. The anticipated expansion reflects the evolving landscape of the Global Drone Camera Market Industry, where technological advancements and diverse applications are likely to play pivotal roles.

Technological Advancements

The Global Drone Camera Market Industry experiences rapid growth due to continuous technological advancements. Innovations in camera resolution, stabilization, and flight control systems enhance the capabilities of drone cameras, making them more appealing to consumers and businesses alike. For instance, the introduction of 4K and 8K cameras in drones has significantly improved image quality, attracting industries such as real estate and agriculture. As a result, the market is projected to reach 18.3 USD Billion in 2024, indicating a strong demand for high-quality aerial imagery. This trend suggests that ongoing research and development will likely drive further expansion in the Global Drone Camera Market Industry.

Regulatory Support and Frameworks

The Global Drone Camera Market Industry is positively influenced by the establishment of regulatory frameworks that support drone operations. Governments worldwide are increasingly recognizing the potential benefits of drone technology, leading to the development of guidelines that facilitate safe and efficient drone usage. For instance, regulations that allow for commercial drone operations have opened new avenues for businesses to leverage drone cameras for various applications. This regulatory support is likely to foster innovation and investment in the sector, further propelling the market's growth. As the industry matures, the alignment of regulations with technological advancements may enhance the overall landscape of the Global Drone Camera Market Industry.

Emerging Markets and Consumer Awareness

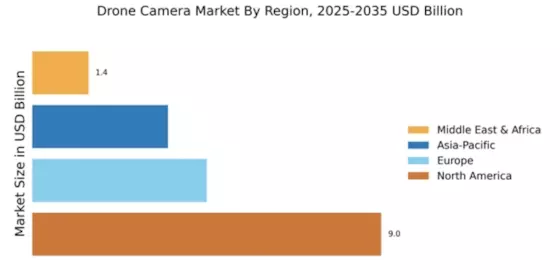

The Global Drone Camera Market Industry is witnessing growth in emerging markets, where increasing consumer awareness and accessibility to drone technology are driving adoption. As prices for drone cameras decrease and technology becomes more user-friendly, a broader audience is likely to engage with these devices. Countries in Asia-Pacific and Latin America are experiencing a surge in interest, as consumers recognize the potential applications of drone cameras in personal and professional settings. This trend suggests that the Global Drone Camera Market Industry will continue to expand as more individuals and businesses in these regions invest in drone technology.

Increased Adoption in Various Industries

The Global Drone Camera Market Industry benefits from increased adoption across diverse sectors, including agriculture, construction, and surveillance. Drones equipped with advanced cameras are utilized for crop monitoring, site inspections, and security surveillance, showcasing their versatility. For example, in agriculture, farmers employ drone cameras to assess crop health and optimize yields, leading to enhanced productivity. This widespread application is expected to contribute to the market's growth, with projections indicating a rise to 236.5 USD Billion by 2035. The diverse use cases across industries suggest that the Global Drone Camera Market Industry will continue to expand as more sectors recognize the value of drone technology.

Growing Demand for Aerial Photography and Videography

The Global Drone Camera Market Industry sees a surge in demand for aerial photography and videography, driven by the increasing popularity of content creation. Social media platforms and streaming services have amplified the need for high-quality visual content, prompting filmmakers, photographers, and influencers to adopt drone cameras. The ability to capture stunning aerial shots has transformed the creative landscape, making drone cameras essential tools for professionals and enthusiasts alike. This trend is expected to contribute to the market's growth, with a projected CAGR of 26.19% from 2025 to 2035. The rising demand for unique visual perspectives indicates a promising future for the Global Drone Camera Market Industry.