Government Support and Investment

the drone camera market benefits from government support and investment aimed at fostering innovation and development within the industry. Initiatives promoting the use of drones for various applications, including disaster management and urban planning, are indicative of this support. The Japanese government has allocated substantial funding to enhance drone technology and infrastructure, which is expected to stimulate market growth. In 2025, government-backed projects could potentially lead to a 10% increase in market size, as public and private sectors collaborate to explore new opportunities. This supportive environment not only encourages technological advancements but also attracts foreign investment, further solidifying Japan's position in the drone camera market.

Expansion of Commercial Applications

the drone camera market is witnessing an expansion of commercial applications, particularly in sectors such as agriculture, infrastructure inspection, and environmental monitoring. The increasing adoption of drone technology for precision agriculture, where farmers utilize drone cameras for crop monitoring and management, is indicative of this trend. Reports suggest that the agricultural sector alone could account for a 20% increase in drone camera usage by 2026. Additionally, infrastructure inspection using drone cameras offers significant cost savings and efficiency improvements, as traditional methods are often time-consuming and labor-intensive. This diversification of applications is likely to drive growth in the drone camera market, as more industries recognize the benefits of aerial data collection.

Growing Interest in Recreational Use

the drone camera market is also experiencing a growing interest in recreational use, particularly among hobbyists and enthusiasts. The rise of social media platforms has fueled this trend, as individuals seek to capture unique aerial footage to share online. In 2025, it is estimated that the recreational segment will contribute approximately 30% to the overall market revenue. This burgeoning interest is further supported by the availability of user-friendly drone models equipped with high-quality cameras, making aerial photography accessible to a broader audience. As more people engage in recreational drone flying, the market is likely to see an influx of new users, thereby enhancing the overall growth of the drone camera market.

Rising Demand for Aerial Photography

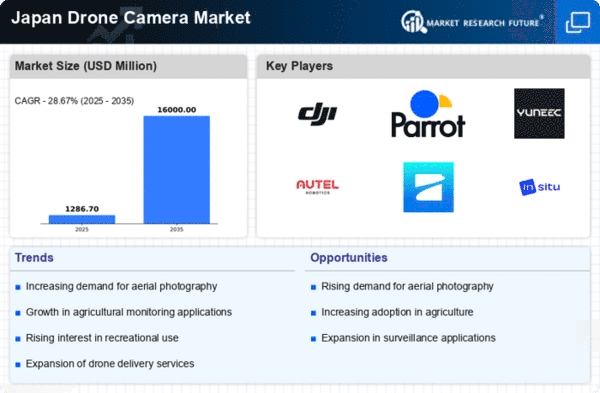

the drone camera market experiences a notable surge in demand for aerial photography, particularly among real estate, tourism, and event management sectors. This trend is driven by the increasing need for high-quality visual content, which drone cameras can provide efficiently. In 2025, the market is projected to grow by approximately 15%, reflecting a shift in consumer preferences towards innovative imaging solutions. The ability of drone cameras to capture stunning aerial views enhances marketing strategies, making them indispensable tools for businesses aiming to stand out in competitive markets. As more industries recognize the value of aerial imagery, the drone camera market is likely to expand further, fostering innovation and attracting new entrants into the industry.

Integration with Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning into the drone camera market is transforming operational capabilities. These technologies enable enhanced image processing, automated flight paths, and real-time data analysis, which are increasingly appealing to various sectors, including agriculture and construction. The market is expected to witness a growth rate of around 12% in the coming years, as businesses leverage these innovations to improve efficiency and reduce costs. Furthermore, the incorporation of AI allows for smarter decision-making processes, which could lead to more effective use of drone cameras in diverse applications. This technological evolution is likely to redefine the landscape of the drone camera market, making it a focal point for investment and development.