Advancements in Drone Technology

Technological innovations play a crucial role in shaping the drone camera market in South Korea. The introduction of advanced features such as 4K video recording, obstacle avoidance systems, and enhanced battery life has made drone cameras more appealing to consumers and businesses alike. These advancements not only improve the user experience but also expand the potential applications of drone cameras. For instance, the integration of artificial intelligence in drone technology allows for automated flight paths and intelligent image capturing, which enhances operational efficiency. As manufacturers continue to invest in research and development, the market is likely to witness the emergence of more sophisticated drone models. This ongoing technological evolution is expected to drive growth in the drone camera market, as consumers seek the latest innovations to meet their diverse needs.

Emergence of Drone Services Market

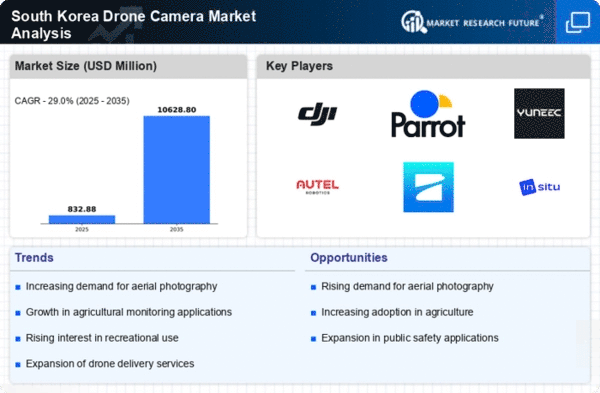

The drone camera market in South Korea is significantly influenced by the emergence of the drone services market. Various industries, including agriculture, logistics, and media, are increasingly adopting drone services for tasks such as aerial inspections, delivery, and content creation. This trend indicates a shift from traditional drone ownership to service-based models, where businesses utilize drone technology without the need for direct investment in equipment. The drone services market is projected to grow at a CAGR of 20% over the next few years, reflecting the increasing reliance on drone technology for operational efficiency. As companies recognize the cost-effectiveness and versatility of drone services, the demand for drone cameras is expected to rise correspondingly, thereby driving growth in the overall drone camera market.

Rising Demand for Aerial Photography

The drone camera market in South Korea is experiencing a significant increase in demand for aerial photography, particularly in sectors such as real estate, tourism, and agriculture. As businesses increasingly recognize the value of high-quality aerial imagery, the market is projected to grow at a CAGR of approximately 15% over the next five years. This growth is driven by the need for innovative marketing strategies and enhanced visual content. Real estate agents utilize drone cameras to provide potential buyers with stunning views of properties, while tourism operators leverage aerial shots to showcase scenic landscapes. Furthermore, agricultural professionals employ drone technology for crop monitoring and management, indicating a diverse application of drone cameras across various industries. The rising demand for aerial photography thus serves as a significant driver for the drone camera market in South Korea.

Increased Investment in Infrastructure

The drone camera market in South Korea benefits from increased investment in infrastructure development. Government initiatives aimed at enhancing urban planning and construction projects have led to a higher demand for drone cameras. These devices are utilized for surveying land, monitoring construction progress, and ensuring compliance with safety regulations. The South Korean government has allocated substantial funds for infrastructure projects, which is anticipated to boost the market for drone cameras significantly. According to recent estimates, the infrastructure sector is expected to grow by 10% annually, creating a favorable environment for drone camera adoption. As construction companies and urban planners recognize the efficiency and accuracy that drone technology offers, the drone camera market is likely to expand in tandem with these infrastructure investments.

Growing Interest in Recreational Drone Use

The drone camera market in South Korea is seeing an increasing interest in recreational drone use, particularly among hobbyists and enthusiasts. As more individuals engage in aerial photography and videography for personal enjoyment, the demand for consumer-grade drone cameras is on the rise. This trend is supported by the increasing availability of affordable drone models equipped with high-quality cameras. Market data suggests that the consumer segment accounts for approximately 40% of total drone camera sales in South Korea. Additionally, social media platforms have fueled this interest, as users share their aerial footage and experiences, further driving demand. The recreational use of drone cameras not only contributes to market growth but also fosters a community of users who advocate for responsible drone operation and safety.