Rise of Recreational Drone Use

The rise of recreational drone use is significantly impacting the drone camera market in the UK. As more individuals engage in hobbies such as aerial photography and videography, the demand for consumer-grade drone cameras is increasing. This trend is particularly evident among younger demographics, who are drawn to the creative possibilities that drone technology offers. Market data suggests that the consumer segment of the drone camera market is expected to grow by approximately 20% in the coming years. This growth is further fueled by the availability of user-friendly models that cater to novice users, making aerial photography accessible to a broader audience. Consequently, the drone camera market is likely to see a diversification of products aimed at hobbyists and enthusiasts.

Expansion of Drone Delivery Services

The expansion of drone delivery services is emerging as a pivotal driver for the drone camera market in the UK. As e-commerce continues to grow, companies are exploring the use of drones for last-mile delivery solutions. This trend necessitates the integration of advanced camera systems for navigation and obstacle avoidance, thereby increasing the demand for sophisticated drone cameras. Recent estimates indicate that the drone delivery market could reach a valuation of £2 billion by 2027, highlighting the potential for growth in this sector. As businesses invest in drone technology to enhance operational efficiency, the drone camera market is likely to benefit from this shift, with increased sales of drones equipped with high-performance cameras.

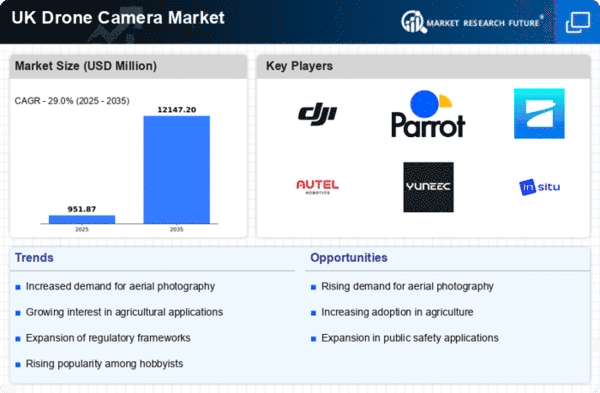

Growing Demand for Aerial Photography

The drone camera market in the UK is experiencing a notable surge in demand for aerial photography services. This trend is driven by various sectors, including real estate, tourism, and event management, which increasingly rely on high-quality aerial imagery to enhance their marketing efforts. The market for drone photography is projected to grow at a CAGR of approximately 15% over the next five years, indicating a robust appetite for innovative visual content. As businesses seek to differentiate themselves, the integration of drone technology into their marketing strategies appears to be a key driver. Furthermore, the accessibility of drone cameras has expanded, allowing even small enterprises to leverage aerial photography, thereby broadening the customer base within the drone camera market.

Increased Investment in Drone Technology

Investment in drone technology is a significant driver for the drone camera market in the UK. With advancements in sensor technology, battery life, and flight stability, manufacturers are increasingly allocating resources to research and development. This investment is expected to yield new models that offer enhanced features, such as improved image resolution and longer flight times. According to recent data, the UK drone technology sector is anticipated to attract over £1 billion in investments by 2026. This influx of capital is likely to stimulate innovation and competition, ultimately benefiting consumers and businesses alike. As a result, the drone camera market is poised for growth, with new entrants and established players alike striving to capture market share.

Enhanced Safety and Surveillance Applications

Enhanced safety and surveillance applications are driving growth in the drone camera market in the UK. Various sectors, including law enforcement, construction, and agriculture, are increasingly adopting drone technology for monitoring and surveillance purposes. The ability to capture real-time footage and conduct aerial inspections has proven invaluable for ensuring safety and compliance. Market analysis indicates that the demand for drones equipped with advanced camera systems for surveillance is expected to rise by 18% over the next few years. This trend reflects a growing recognition of the benefits that drone technology can provide in enhancing operational safety and efficiency. As industries continue to embrace these applications, the drone camera market is likely to see sustained growth.