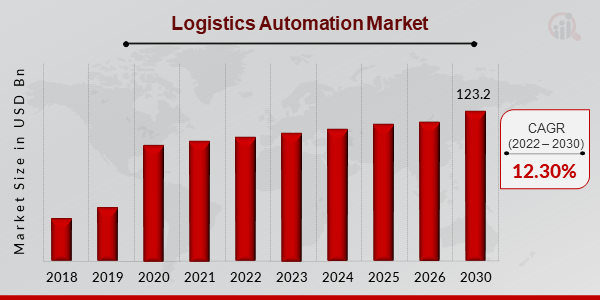

The Logistics Automation Market is currently experiencing a transformative phase, driven by advancements in technology and the increasing demand for efficiency in supply chain operations. Automation solutions, such as robotics, artificial intelligence, and data analytics, are being integrated into logistics processes to enhance productivity and reduce operational costs. Companies are increasingly recognizing the necessity of adopting these innovations to remain competitive in a rapidly evolving landscape. As a result, the market is witnessing a surge in investments aimed at modernizing logistics infrastructure and streamlining operations. Moreover, the emphasis on sustainability and environmental responsibility is shaping the Logistics Automation Market. Organizations are exploring automated solutions that not only improve efficiency but also minimize their carbon footprint.

This dual focus on operational excellence and ecological impact suggests a shift in priorities among logistics providers. The ongoing evolution of consumer expectations, coupled with the need for real-time visibility and responsiveness, further indicates that the Logistics Automation Market is poised for continued growth and adaptation in the coming years. Logistics automation enables organizations to streamline supply chain operations using robotics, artificial intelligence, and advanced software solutions. Automation in logistics is transforming traditional supply chains by reducing manual intervention and improving operational accuracy.

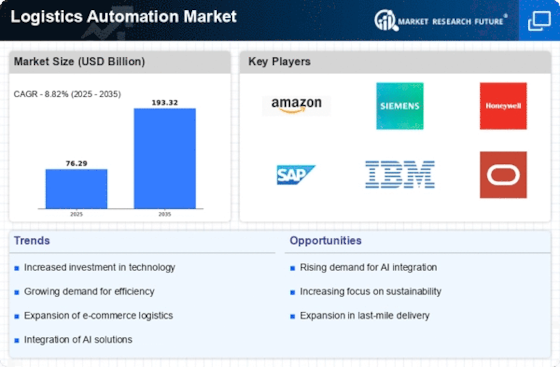

Logistics automation software supports real-time visibility, predictive analytics, and intelligent decision-making across supply chains. A logistics automation system integrates hardware, software, and data analytics to optimize warehouse and transportation operations. The growing demand for end-to-end logistics automation solutions is fueled by rising e-commerce volumes and supply chain complexity. Logistics automation companies such as Amazon, Siemens, and Honeywell are driving innovation through robotics and AI-powered platforms.

Integration of Artificial Intelligence

The incorporation of artificial intelligence into logistics processes is becoming increasingly prevalent. AI technologies facilitate predictive analytics, enabling companies to forecast demand more accurately and optimize inventory management. This trend appears to enhance decision-making capabilities and streamline operations. Logistics process automation improves workflow efficiency by automating repetitive tasks such as sorting, routing, and inventory tracking. The warehouse automation industry plays a critical role in the logistics automation market by enabling faster picking, packing, and storage.

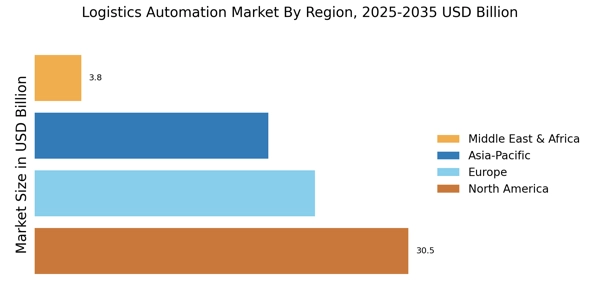

Rapid logistics industry growth, particularly in e-commerce and retail, is accelerating investments in automation technologies. The increasing adoption of logistic automation reflects a broader shift toward technology-driven supply chain management. A modern logistic automation system supports faster processing and improved accuracy in logistics operations. Within the broader logistic software market, logistics automation platforms are gaining prominence. Automation in the transportation industry supports route optimization, freight management, and last-mile delivery efficiency. Organizations are investing in digital tools to automate logistics and reduce operational costs.

Rise of Robotics and Automation

The deployment of robotics in warehousing and distribution centers is gaining traction. Automated guided vehicles and robotic picking systems are being utilized to improve efficiency and reduce labor costs. This trend suggests a shift towards more automated environments in logistics.

Focus on Sustainability

There is a growing emphasis on sustainable practices within the Logistics Automation Market. Companies are seeking solutions that not only enhance operational efficiency but also contribute to environmental goals. This trend indicates a broader commitment to sustainability in logistics operations.