Rising Threat of CBRNE Incidents

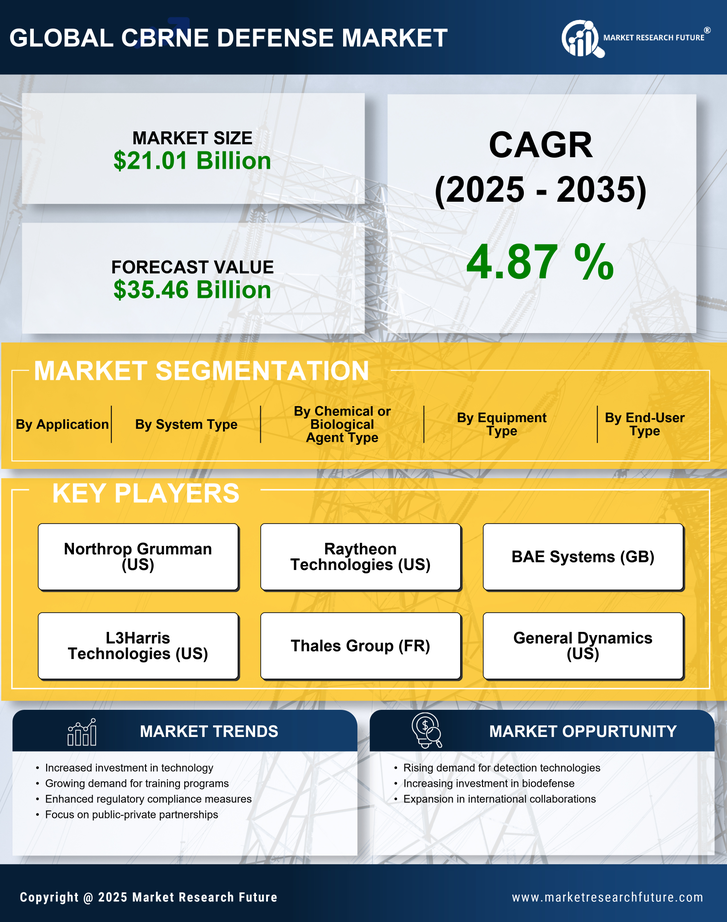

The increasing frequency of CBRNE incidents, including chemical, biological, radiological, nuclear, and explosive threats, appears to be a primary driver for the cbrne defense Market. Governments and organizations are increasingly aware of the potential for terrorist attacks and accidental releases of hazardous materials. This heightened awareness has led to a surge in demand for advanced detection and response systems. According to recent estimates, the CBRNE Defense Market is projected to grow at a compound annual growth rate of approximately 5.2% over the next five years. This growth is indicative of the urgent need for enhanced security measures and preparedness strategies to mitigate the risks associated with CBRNE threats.

Emerging Technologies in CBRNE Defense

The advent of emerging technologies, such as artificial intelligence, machine learning, and advanced robotics, is transforming the CBRNE defense Market. These technologies are being integrated into detection systems, enabling faster and more accurate identification of CBRNE agents. For example, AI-driven analytics can process vast amounts of data to predict potential threats, while robotics can be deployed in hazardous environments for reconnaissance and decontamination. The integration of these technologies is expected to enhance operational efficiency and effectiveness, thereby attracting investments and driving market growth. As organizations seek to modernize their defense capabilities, the demand for innovative solutions in the CBRNE Defense Market is likely to increase.

Public Awareness and Preparedness Initiatives

Public awareness and preparedness initiatives are emerging as vital components of the CBRNE Defense Market. Governments and non-governmental organizations are investing in educational programs aimed at informing citizens about the risks associated with CBRNE threats. These initiatives not only enhance community resilience but also drive demand for training and preparedness solutions. As individuals become more informed about potential threats, there is a corresponding increase in the need for personal protective equipment and emergency response training. This trend is expected to contribute to the growth of the CBRNE Defense Market, as stakeholders recognize the importance of equipping both professionals and the public with the necessary tools to respond effectively to CBRNE incidents.

Government Investments in Defense Technologies

Government investments in defense technologies are likely to play a crucial role in shaping the CBRNE Defense Market. Many nations are allocating substantial budgets to enhance their defense capabilities, particularly in response to evolving threats. For instance, the U.S. Department of Defense has earmarked billions for research and development in CBRNE defense technologies. This financial commitment not only fosters innovation but also encourages collaboration between public and private sectors. As a result, the market is witnessing the emergence of cutting-edge solutions that address the complexities of CBRNE threats, thereby driving growth and enhancing national security.

International Regulatory Frameworks and Standards

The establishment of international regulatory frameworks and standards is influencing the CBRNE Defense Market. Organizations such as the United Nations and the World Health Organization are actively promoting guidelines for the safe handling and disposal of hazardous materials. Compliance with these regulations is becoming increasingly critical for governments and industries alike. As a result, there is a growing demand for products and services that meet these stringent standards. Companies that can demonstrate compliance with international regulations are likely to gain a competitive edge in the CBRNE Defense Market, as stakeholders prioritize safety and reliability in their procurement processes.