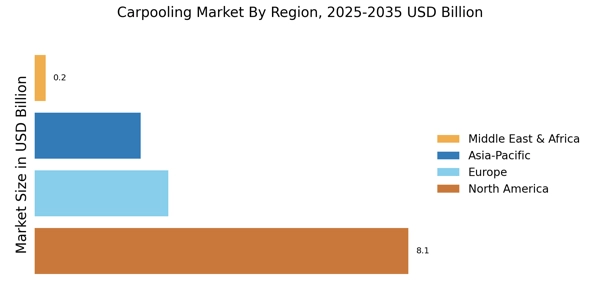

North America : Leading Innovation and Adoption

North America is witnessing significant growth in the carpooling market, driven by increasing urbanization, rising fuel costs, and a growing emphasis on sustainable transportation. The United States holds the largest market share at approximately 70%, followed by Canada at around 15%. Regulatory support for carpooling initiatives, such as tax incentives and infrastructure investments, is further catalyzing this growth. The competitive landscape is dominated by key players like Uber, Lyft, and Waze Carpool, which are leveraging technology to enhance user experience. The presence of these companies, along with emerging platforms like Zimride and Commute with Enterprise, is fostering a dynamic environment. As more consumers seek cost-effective and eco-friendly commuting options, the market is expected to expand rapidly in the coming years.

Europe : Sustainable Mobility Initiatives

Europe is emerging as a significant player in the carpooling market, driven by stringent environmental regulations and a strong push for sustainable mobility solutions. The largest market is Germany, holding approximately 30% of the share, followed closely by France at 25%. Government initiatives aimed at reducing carbon emissions and promoting shared mobility are key growth drivers in this region. Countries like France and Germany are home to major players such as BlaBlaCar and Carpool World, which are leading the charge in carpooling services. The competitive landscape is characterized by a mix of established companies and new entrants, all vying for market share. The European market is expected to continue evolving, with increasing consumer acceptance of carpooling as a viable transportation option.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing a burgeoning interest in carpooling, driven by rapid urbanization, increasing traffic congestion, and a growing middle class. China is the largest market, accounting for approximately 40% of the share, followed by India at around 20%. Government policies promoting shared mobility and reducing urban congestion are significant catalysts for market growth in this region. Leading players in the Asia-Pacific market include local startups and international companies, with a focus on mobile app-based solutions. The competitive landscape is diverse, with various platforms emerging to cater to the unique needs of urban commuters. As awareness of environmental issues grows, carpooling is becoming an attractive option for many consumers in this region, paving the way for future expansion.

Middle East and Africa : Growing Urban Mobility Solutions

The Middle East and Africa region is gradually embracing carpooling as a solution to urban mobility challenges. The largest market is South Africa, holding about 25% of the share, followed by the UAE at 15%. Factors such as increasing urbanization, high fuel prices, and a need for efficient transportation options are driving demand for carpooling services in this region. In South Africa, local platforms are emerging to meet the needs of commuters, while in the UAE, international players are making inroads. The competitive landscape is evolving, with a mix of traditional taxi services and new carpooling apps. As the region continues to develop its infrastructure, carpooling is expected to gain traction as a sustainable transportation alternative.