North America: Increasing awareness around energy efficiency, monitoring projects providing remote access, and goals towards sustainability, in urban and rural applications

The North America LoRaWAN market is experiencing robust growth, and smart technology adoption, smart and low-power, wide-area network (LPWAN) solutions are on the rise in the region's sophisticated IoT ecosystem. The US and Canada are leading the North America LoRaWAN market, supported by early adoption in application areas such as smart metering, precision agriculture, industrial automation, asset tracking, and smart cities. Key enablers include a well-established infrastructure for wireless communication, supportive regulatory policies, private and public sector capitalization to augment digital transformation initiatives, and well-known LoRaWAN ecosystem players in the region ranging from chip manufacturers , gateway providers , network operators, and system integrators.

Technology trends support and encourage scalable and reliable deployments, with existing demand for LoRaWAN network denser development, edge computing integration, improved availability, and capabilities in security protocols. In addition, collaborative projects and programs offered by public-private partnerships and open networks from providers, such as The Things Network and Senet are driving new use cases for LoRaWAN. Increasing awareness in the region around energy efficiency, monitoring projects providing remote access, and goals towards sustainability are complementary, adding further support for LoRaWAN in urban and rural applications.

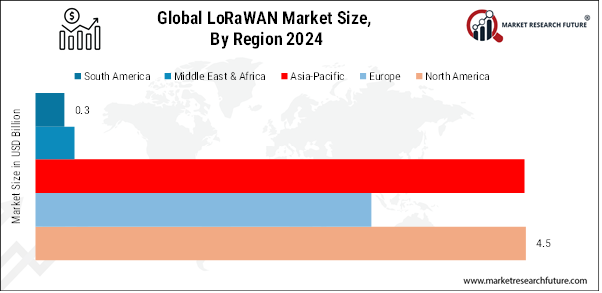

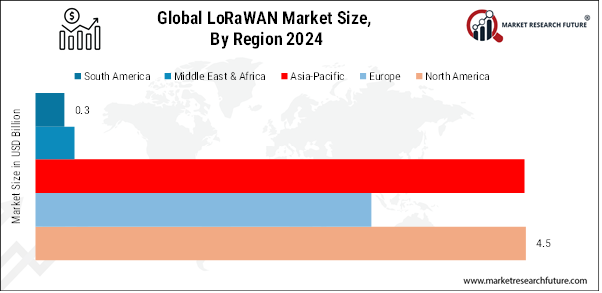

North America held the majority regional market share in 2024

Europe: Regulatory alignment, cross-border interoperability, and support for open standards-based IoT architectures

The LoRaWAN market in Europe is exhibiting significant momentum, underpinned by excellent regulatory alignment, cross-border interoperability, and overall support for open standards-based IoT architectures. In addition, there has been early adoption in sectors such as smart utilities, precision agriculture, environmental monitoring, and public utilities. These sectors will reap the benefits of EU-wide, national digital transformation, and sustainability policies. The largest implementations of LoRaWAN are being led by France, Germany, the Netherlands, and the UK, with both national telecom providers and public-private cooperation. They are supported by European initiatives, such as the European IoT Alliance and the LoRa Alliance, to create an open innovation ecosystem and drive standardization. The availability of the 868 MHz non-licensed ISM band is supported in most of Europe, allowing simple and cost-effective LPWAN deployments.

In addition, Europe's strong focus on data privacy, security (i.e.: GDPR compliance), and network reliability has enabled the construction of secure-by-design LoRaWAN systems. Community networks along with roaming between service providers are further enhancing coverage and mobility. Even with competition from other types of LPWAN technology such as NB-IoT (i.e.: cellular) or Sigfox, LoRaWAN's flexibility, open architecture, and energy efficiency will propel it to be a primary enabler for Europe's long-term IoT strategies.

Asia-Pacific: Rapid urbanization, adoption of IoT-based applications, and significant government support for smart infrastructure

The Asia Pacific LoRaWAN market is witnessing accelerated growth, driven by rapid urbanization, the adoption of IoT-based applications continuing to grow, and significant government support for smart infrastructure, among other developments. Countries across the region are exploring ways to deploy LoRaWAN technology to satisfy various public and private sector applications in a range of industry categories, including agriculture, smart cities, utilities, logistics, and industrial automation. Major economies such as China, India, Japan, South Korea, and Australia are at the forefront of economic growth, and their respective LoRaWAN deployments show no signs of abating. Given the region's immense geographic and demographic diversity will always yield unique connectivity challenges, LoRaWAN's capability to connect many devices at low power and long ranges in dense urban areas or remote rural communities is particularly relevant.

The regulatory landscape around LoRaWAN deployment is quite broad across Asia Pacific countries, but there is some convergence around various sub-GHz, ISM band frequencies (some examples include 865-867 MHz in India, and 920-925 MHz in SE Asia) which supports easier adoption. Nationally and regionally, governments in the Asia Pacific are developing regulatory programs to enable IoT digital transformation (e.g., Digital India, China's New Infrastructure, Japan's Society 5.0) in conjunction with IoT policy networks that enable candidates for certain local IoT applications to link to LoRaWAN.

Furthermore, telecom operators are increasing their investments into IoT startups and public and private LoRaWAN network deployments, which means more funding for expanding public LoRaWAN networks coupled with increased diversity of applications. The prominence of leading hardware manufacturers and technology providers in the region will further drive innovation, as well as speed toward cost efficiencies for deployment of LoRaWAN-based devices. There are impediments to adoption from recent LPWAN deployment standards, such as regulatory fragmentation, problems with interoperability, and competition from other LPWA standards, including NB-IoT and Sigfox. Despite these hurdles, LoRaWAN is achieving increased adoption in ASEAN regions, with many opportunities ahead.

South American: Demand for low-power, low-cost IoT connectivity in sectors such as agriculture, utilities, environmental monitoring, and urban infrastructure.

The South America LoRaWAN market is gradually emerging due to the increasing demand for low-power, low-cost IoT connectivity in sectors such as agriculture, utilities, environmental monitoring, and urban infrastructure. Brazil, Argentina, Chile, and Colombia have taken the lead in regional adoption and are deploying LoRaWAN for applications such as smart metering, precision agriculture, flood monitoring, and waste management. Because of the area’s large geographical variety, LoRaWAN’s long-range and low-power properties offer the potential advantage of transmitting data across greater distances to remote rural populations. Brazil has seen active deployments in the sector from various stakeholders, including public, private, and national regulations, allowing unlicensed access to the 902-907.5 MHz and 915-928 MHz RF bands. Although overall network coverage and ecosystem maturity is still in the early stages of development for nearly all sectors, there remains limited availability for public LoRaWAN infrastructure outside major urban areas.

Nonetheless, telecom operators, IoT startups, and global alliances such as the LoRa Alliance are collaborating efforts with these deployments to develop the market ecosystem. Additionally, the model of decentralized and low-maintenance systems, as in LoRaWAN, fits well with the regional infrastructure challenges. As South American governments continue to emphasize digital transformation initiatives and smart city developments, demand for scalable and low-cost IoT connectivity solutions is expected to rise significantly within North, Central and South America and position LoRaWAN as a suitable and strategic technology.

Middle East & Africa: increasing demand for scalability and low-power IoT solutions.

The Middle East & Africa (MEA) region presents an expanding opportunity for the LoRaWAN market. It is driven by the increasing demand for scalability and low-power IoT solutions across urban infrastructure, agriculture, energy, and environmental monitoring. In the Middle East, countries such as the UAE, Saudi Arabia and Qatar are adopting LoRaWAN use in smart city frameworks as part of national digital transformation agendas e.g.: Saudi Vision 2030, UAE Smart City Strategy, which focus on efficient resource management, connected utilities and intelligent public services where LoRaWAN provides low cost wide area connectivity that consumes very little energy.

In Africa, the technology's unique ability to operate in remote areas with little infrastructure enables precision agriculture, water conservation and off-grid monitoring capabilities. Nevertheless, the deployment remains fragmented due to differences in regulations, geography, limited awareness and lack of assured widespread infrastructure. Regional telecom operators, IoT startups and global technology vendors take a leading role within initial deployments and ecosystem development.

In addition, spectrum including the 868 MHz and 915 MHz bands and the emergence of public and community-based LoRaWAN networks are further enabling incremental growth. As the MEA region continues to seek enhanced sustainability, connectivity and digitization LoRaWAN is positioned to accelerate and be a key enabler of resilient and smart cities.

|

Region

|

Share of Global Market (2024s est.)

|

Key Drivers

|

Outlook 2025–2035

|

|

North America

|

~Medium

|

Increasing awareness around energy efficiency, monitoring projects providing remote access, and goals towards sustainability, in urban and rural applications

|

Stable growth, strong in fleets

|

|

Europe

|

~Medium

|

Regulatory alignment, cross-border interoperability, and support for open standards-based IoT architectures

|

Mature, regulatory driven

|

|

Asia-Pacific

|

~Height

|

Rapid urbanization, adoption of IoT-based applications, and significant government support for smart infrastructure

|

Moderate CAGR

|

|

Middle East & Africa

|

~low

|

Demand for low-power, low-cost IoT connectivity in sectors such as agriculture, utilities, environmental monitoring, and urban infrastructure

|

Emerging growth, infrastructure-led

|

|

South America

|

~low

|

increasing demand for scalability and low-power IoT solutions

|

Potential Markets

|