Innovation Management Systems Market Summary

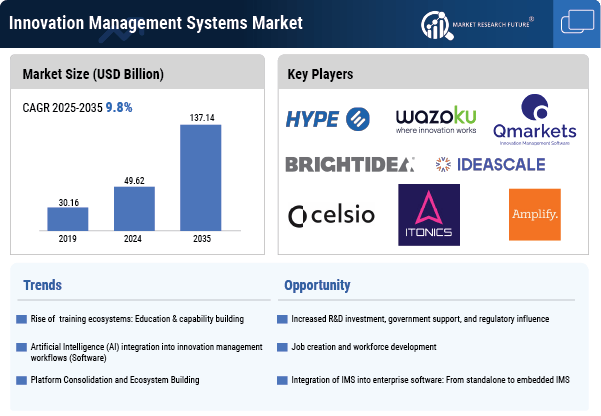

As per MRFR analysis, the Innovation Management Systems Market Size was estimated at 49.55 USD Million in 2024. The Innovation Management Systems industry is projected to grow from 53.8 in 2025 to 137.53 by 2035, exhibiting a compound annual growth rate (CAGR) of 9.83 during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Innovation Management Systems Market is experiencing robust growth driven by technological advancements and a shift towards collaborative innovation.

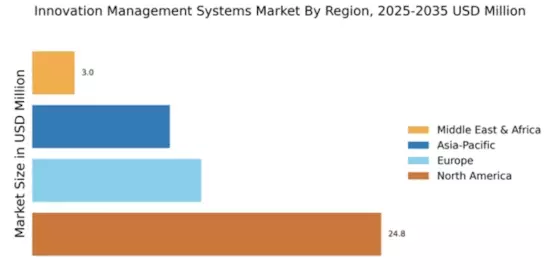

- The market witnesses increased adoption of cloud-based solutions, particularly in North America, which remains the largest market.

- Data-driven decision making is becoming a focal point for organizations, enhancing the effectiveness of innovation strategies across sectors.

- Collaboration and open innovation are gaining traction, especially in the Asia-Pacific region, which is recognized as the fastest-growing market.

- The growing demand for innovation and a focus on customer-centric approaches are key drivers propelling the expansion of the Idea Management and Hybrid segments.

Market Size & Forecast

| 2024 Market Size | 49.55 (USD Million) |

| 2035 Market Size | 137.53 (USD Million) |

| CAGR (2025 - 2035) | 9.83% |

Major Players

Planview (US), HYPE Innovation (DE), Brightidea (US), Spigit (US), IdeaScale (US), Qmarkets (IL), Crowdicity (GB), InnovationCast (CA), Exago (PT)