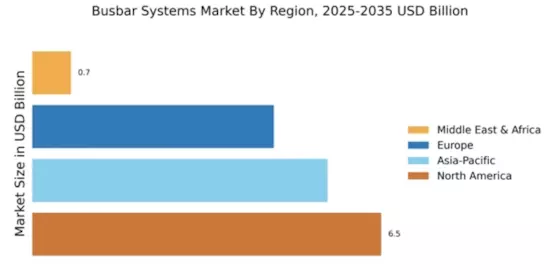

January 2023:The American government committed USD 2.7 billion to improving and expanding the nation's rural power infrastructure. The strategy is predicted to increase grid security, upgrade and develop the country's rural electric system, contributing to industry growth.

September 2021:The largest manufacturer of busbar systems in the G.C.C., E&I Engineering Ireland, and its UAE-based affiliate, Powerbar Gulf, will be acquired by Vertiv Holdings Company for USD 1.8 billion in advance consideration plus the possibility of up to USD 200 million in cash. Vertiv Holdings Company provides vital digital infrastructure and continuity solutions globally.

March 2020:ABB Ltd.'s electrification business unit purchased a sizable stake in Shanghai Charge Dot New Energy Technology Co., Ltd.

January 2020:A Redditch-based producer of automotive technology awarded Samuel Taylor Limited a contract to help develop E.V.s. The first company will manufacture parts and bi-metals to develop battery busbar technology.

For example, one of the power transmission developers, Sterlite Power, ended its fiscal year (FY24) in April 2024 by getting orders worth Rs. 2,500 Cr for high-performance conductors, which accounted for as much as its Global Products and Services (GPS) business unit in Q4.

April 2024: Referro Systems is a distributor of Rockwell Automation products authorized by Rockwell Automation Company in South Africa, and they have launched Cu-Flex flexible copper busbars.

In April 2024, for instance, Legrand said that its track busway system provides flexibility that traditional power distribution systems do not have.

Pickering Interfaces is an industry-leading modular simulation and signal-switching product provider designed specifically for electronic testing and verification. In this regard, the company came up in April 2024 with high-density PXIe and PXI multiplexer (MUX) modules targeting high-voltage applications. Moreover, the adoption of electric busways is further accelerated by continuous improvements in the industrial sector. These use busbars to distribute electricity in large structures such as factories efficiently. They are also made up of conductive bars that typically contain aluminum or copper materials to safely carry high-current electricity.

Signal Hound is an example of a manufacturer of precision test equipment that announced the addition of RFS44 into their product range in April 2024. In line with this development was Schneider Electric’s announcement of EasySet MV air-insulated indoor switchgear at some time after April 2024 as well. This environmentally friendly and original switchgear will facilitate easy operation and maintenance during the delivery of electrical services to boost revenues from the busbar market.

March 2024: ABB has introduced FlexLine – new generation modular protection devices specifically designed for quick installation at residential buildings or small commercial facilities. The series includes residual current devices (RCD), miniature circuit breakers (MCB), and arc fault detection devices (AFDD), all with push-in technology that can be combined in any required configuration on one single busbar type.

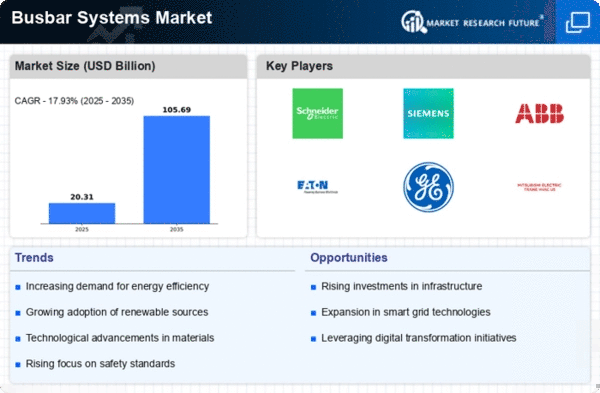

February 2024: Since acquiring PowerBar Gulf and E&I Engineering switchgear, busway, and IMS business in 2021, Vertiv’s busway, switch gear, and integrated modular solutions (IMS) business has grown by over 100%. The company plans to continue adding capacity through expansions through the end of 2025.

February 2024: A group of researchers from Spain led by the Centre for Energy, Environmental and Technological Research (CIEMAT) have come up with a number of ways to repair ribbon busbar interruptions in photovoltaic panels.