Growth of Renewable Energy Sector

The expansion of the renewable energy sector in South Korea is a critical driver for the busbar systems market. As the country invests heavily in solar and wind energy projects, the need for robust electrical distribution systems becomes increasingly evident. Busbar systems are essential for connecting renewable energy sources to the grid, ensuring efficient power transfer and distribution. Recent statistics indicate that renewable energy accounted for approximately 20% of the total energy mix in South Korea, with expectations for this figure to rise significantly in the coming years. This growth presents a substantial opportunity for the busbar systems market, as the integration of renewable energy necessitates advanced electrical solutions that can handle variable loads and enhance grid stability.

Government Initiatives and Regulations

In South Korea, government initiatives aimed at enhancing energy efficiency and promoting renewable energy sources significantly impact the busbar systems market. Regulatory frameworks encourage the adoption of advanced electrical systems, including busbars, to facilitate the integration of renewable energy into the grid. The government has set ambitious targets for reducing carbon emissions, which necessitates the modernization of existing electrical infrastructure. As a result, investments in busbar systems are likely to increase, driven by both public and private sectors. The busbar systems market stands to gain from these initiatives, as compliance with regulations often leads to the adoption of more efficient and sustainable technologies. This regulatory environment fosters innovation and encourages manufacturers to develop cutting-edge solutions that align with national energy goals.

Urban Development and Infrastructure Projects

Urban development and large-scale infrastructure projects in South Korea significantly influence the busbar systems market. As cities expand and new commercial and residential buildings emerge, the demand for efficient electrical distribution systems escalates. Busbar systems are particularly well-suited for high-rise buildings and large facilities, where traditional wiring methods may prove inadequate. Recent urbanization trends indicate a steady increase in construction activities, with the government investing heavily in infrastructure development. This trend is expected to drive the busbar systems market, as developers and contractors seek reliable and efficient solutions to meet the growing energy demands of urban environments.

Rising Demand for Efficient Power Distribution

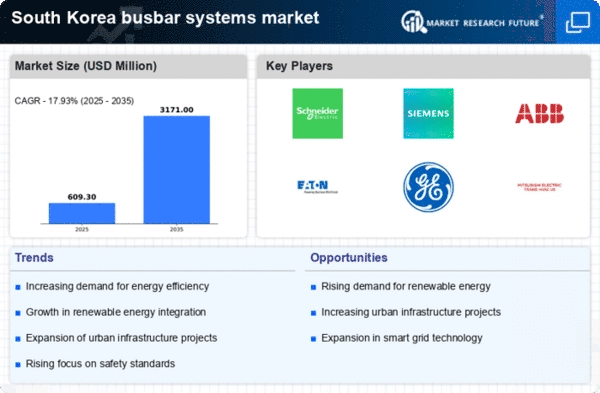

The busbar systems market in South Korea experiences a notable surge in demand due to the increasing need for efficient power distribution solutions. As urban areas expand and industrial activities intensify, the requirement for reliable electrical infrastructure becomes paramount. Busbar systems, known for their ability to handle high current loads with minimal losses, are increasingly favored in commercial and industrial applications. According to recent data, the market is projected to grow at a CAGR of approximately 6.5% over the next five years. This growth is driven by the need for enhanced energy efficiency and reduced operational costs, making busbar systems a preferred choice for many enterprises. The busbar systems market is thus positioned to benefit from this trend, as businesses seek to optimize their energy consumption and improve overall operational efficiency.

Technological Innovations in Electrical Systems

Technological innovations play a pivotal role in shaping the busbar systems market in South Korea. The advent of smart grid technologies and automation in electrical systems has led to the development of more sophisticated busbar solutions. These innovations enhance the performance, reliability, and safety of electrical distribution networks. For instance, the integration of IoT devices allows for real-time monitoring and management of busbar systems, improving operational efficiency. As industries increasingly adopt these advanced technologies, the demand for modern busbar systems is expected to rise. The busbar systems market is likely to benefit from this trend, as companies seek to leverage technology to optimize their energy management and reduce downtime.